How can I enter multiple payments and advances in a loan without having to enter them one by one? I have over 100 in one loan. I have the data in Excel.

Q: How can I enter multiple payments and advances in a loan without having to enter them one by one? I have over 100 in one loan. I have the data in Excel.

A: Very easily, in seconds with a simple 4-column Excel sheet.

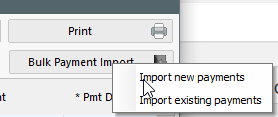

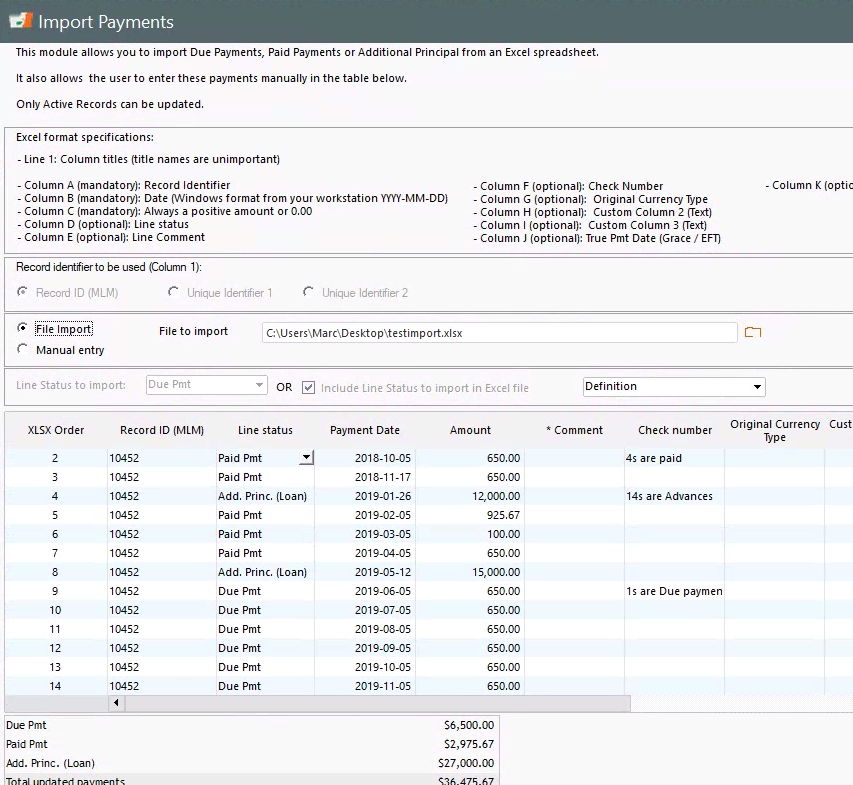

Go to Tools > Post Payments. On the top of the window, far right, you will see the “Bulk Payment Import” button. Of the two options, choose “Import new payments” (payments can be actual paid payments, upcoming payments, advances (additional principal), etc.)

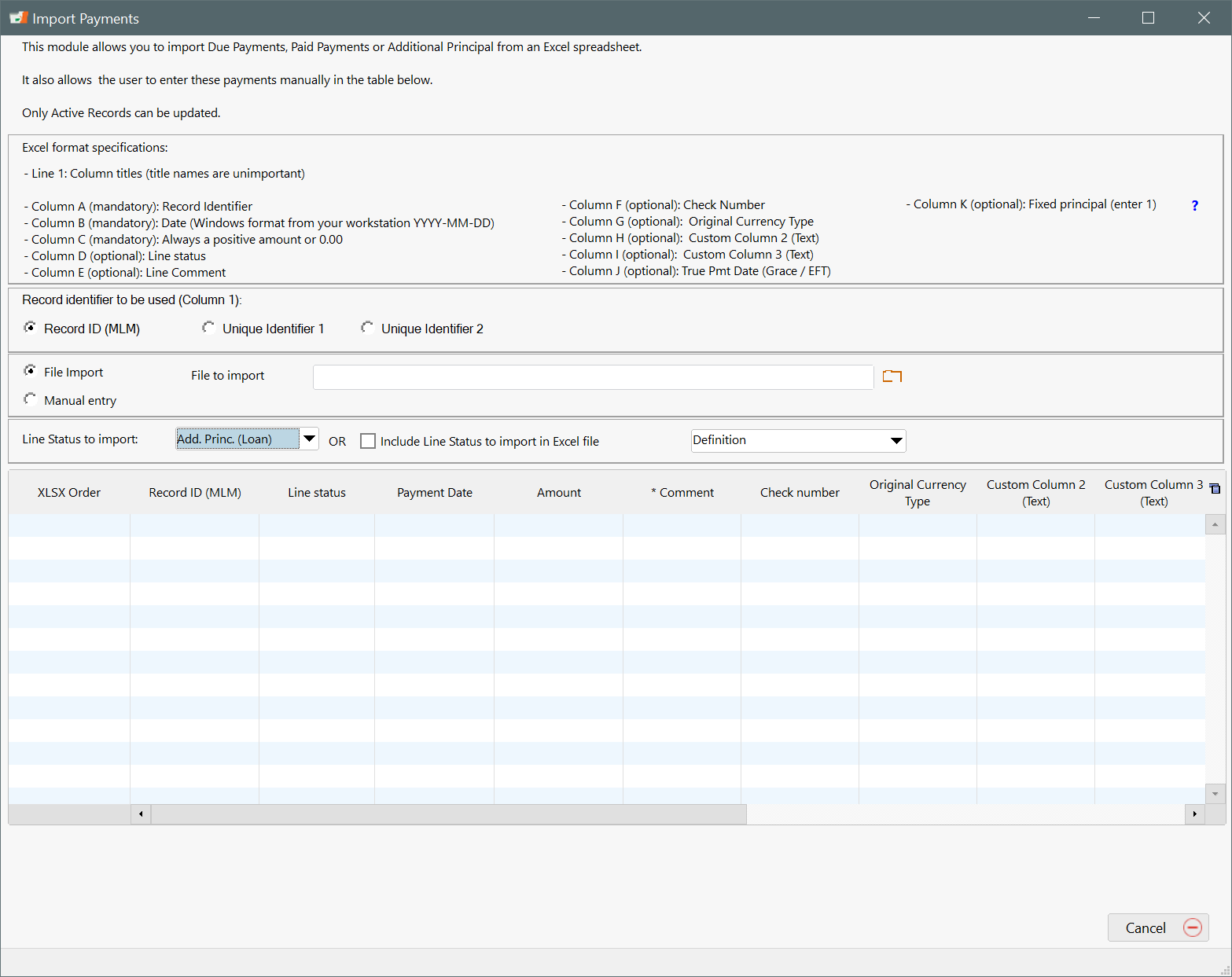

The window will then show you the required Excel file format with the 3 required data columns and others that are optional:

- Column A is the loan ID (this can be the MLM ID or your unique ID)

- Column B is the Date

- Column C is the amount (always positive)

- Column D, in this case required since you are importing payments and advances, will specify what the amount is (a payment, what type of payment or an advance)

You can add additional information such as a line comment, a check number, other data, even that the payment should be a fixed principal payment (see the ?).

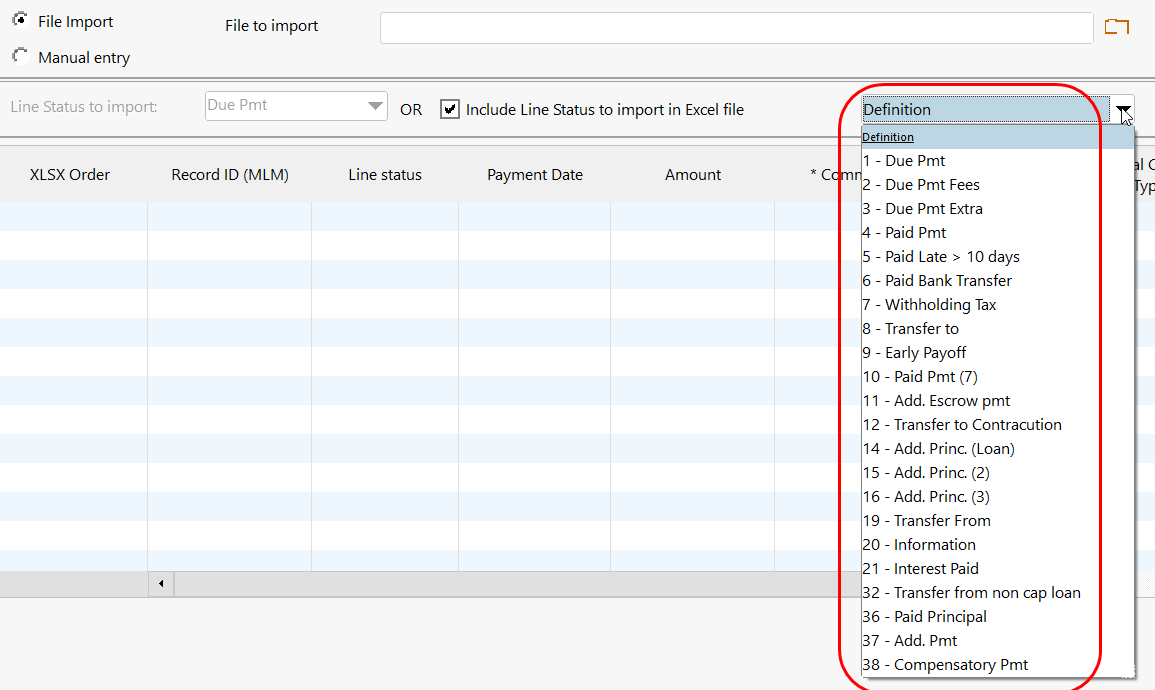

For Column D of the Excel file, you would specify what the amount is:

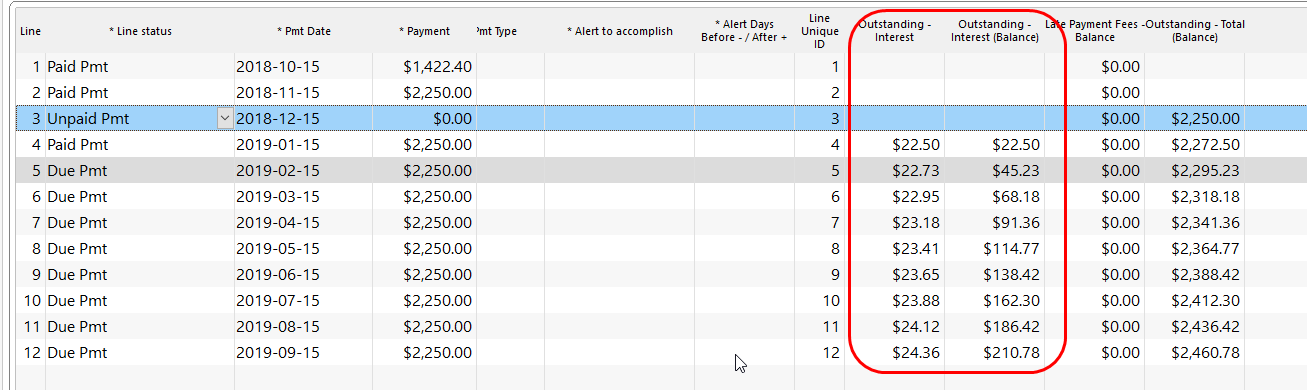

A Paid Payment would be a 4 in column D, and an advance would be a 14. If an amount is due but not yet paid, then this would be a 1 (so something in the future, not in the past).

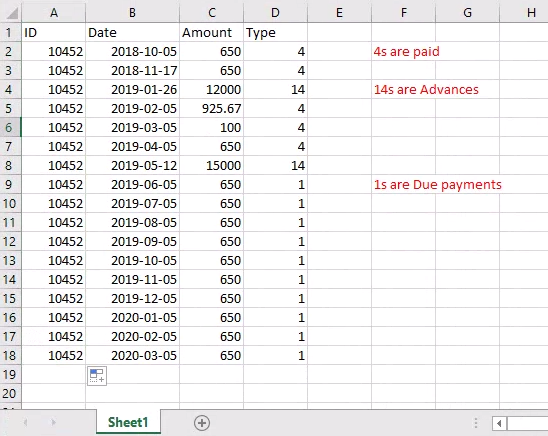

Here is a sample Excel sheet with 2 advances (12,000 and 15,000), 5 Paid payments and 10 Due payments in the future:

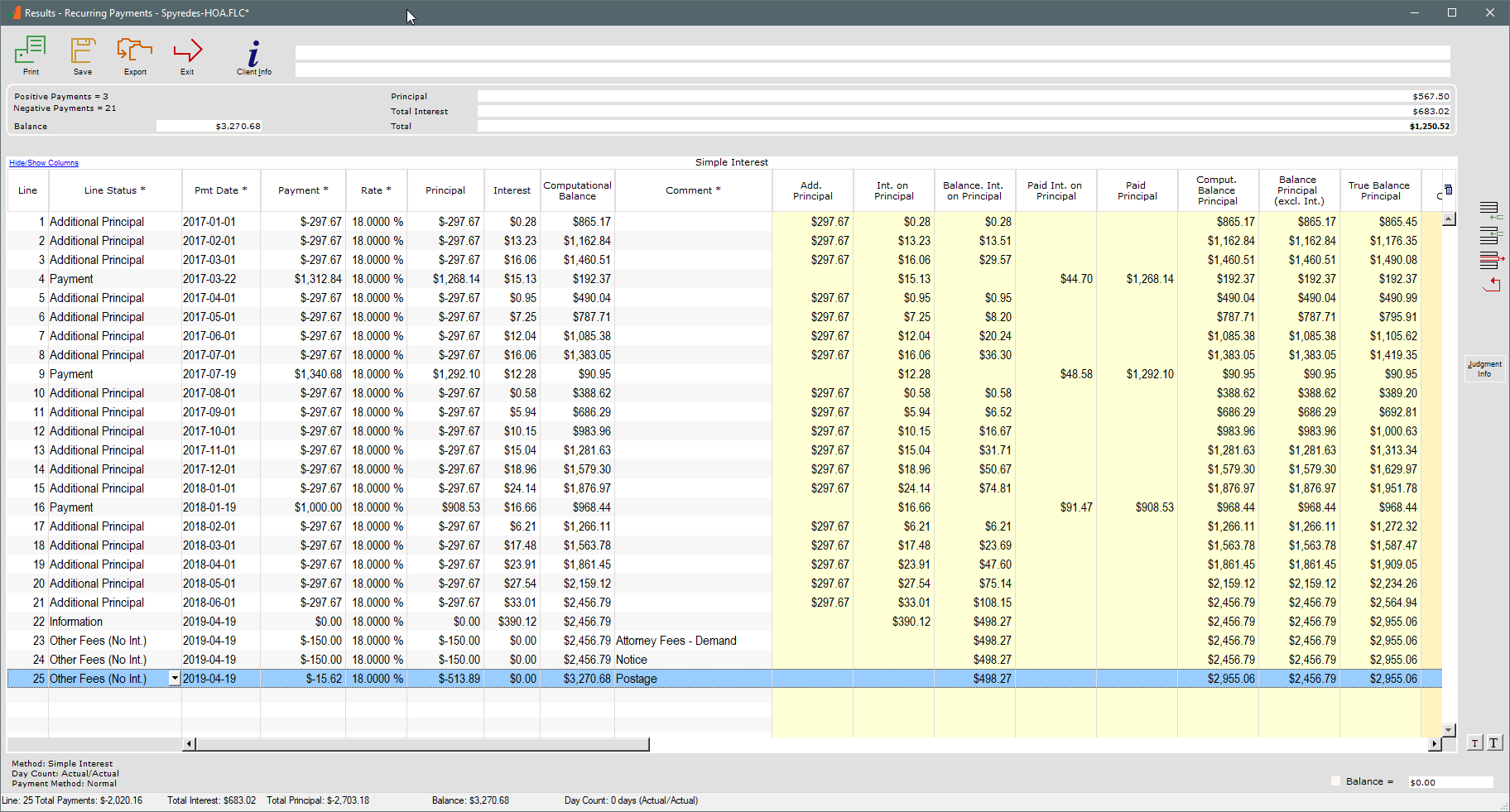

The result is all good since no errors are shown. Errors would be shown in red with descriptions of whey they are in error (wrong dates, illogical scenarios, loan is not Active, etc.): To import press on “Insert lines”:

See also: Importing batch payments in Margill Loan Manager (CSV, Excel)