Automated invoice numbering

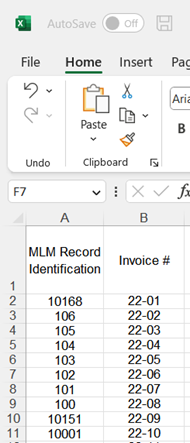

Q: I created an invoice in Margill (via Document Merge) and would like to know if it can number the invoices automatically.

A: A few options are available in Margill

First method:

By using the Global Changes function import your invoice numbers directly into your Records.

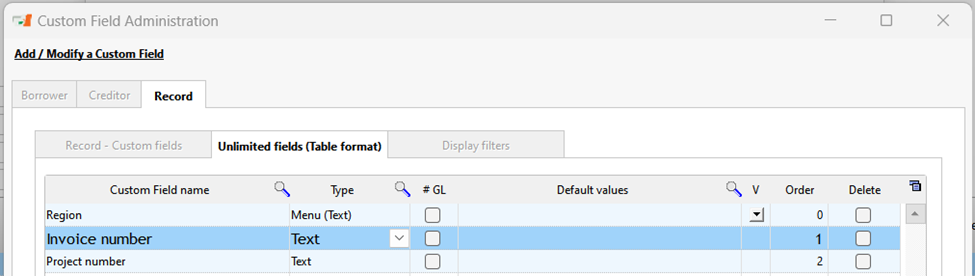

Let’s start by creating a Custom field to import your invoice numbers.

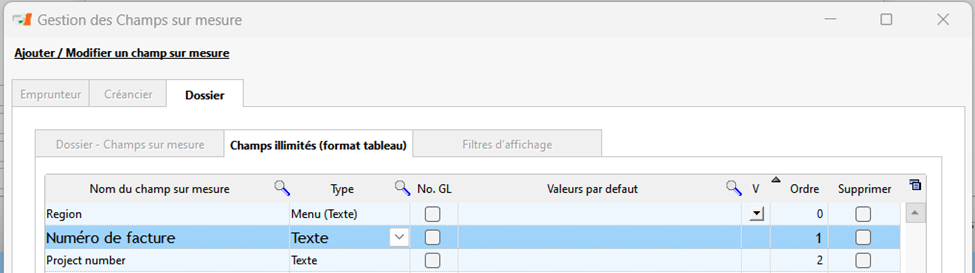

Go to Tools > Settings > Custom Fields > Record > Unlimited Fields (Table format)

Please note that if you wish to keep historical invoice numbers, you will have to create a new field for each invoicing cycle (ex. Invoice number 2023) (this is less practical if the invoices are sent every month).

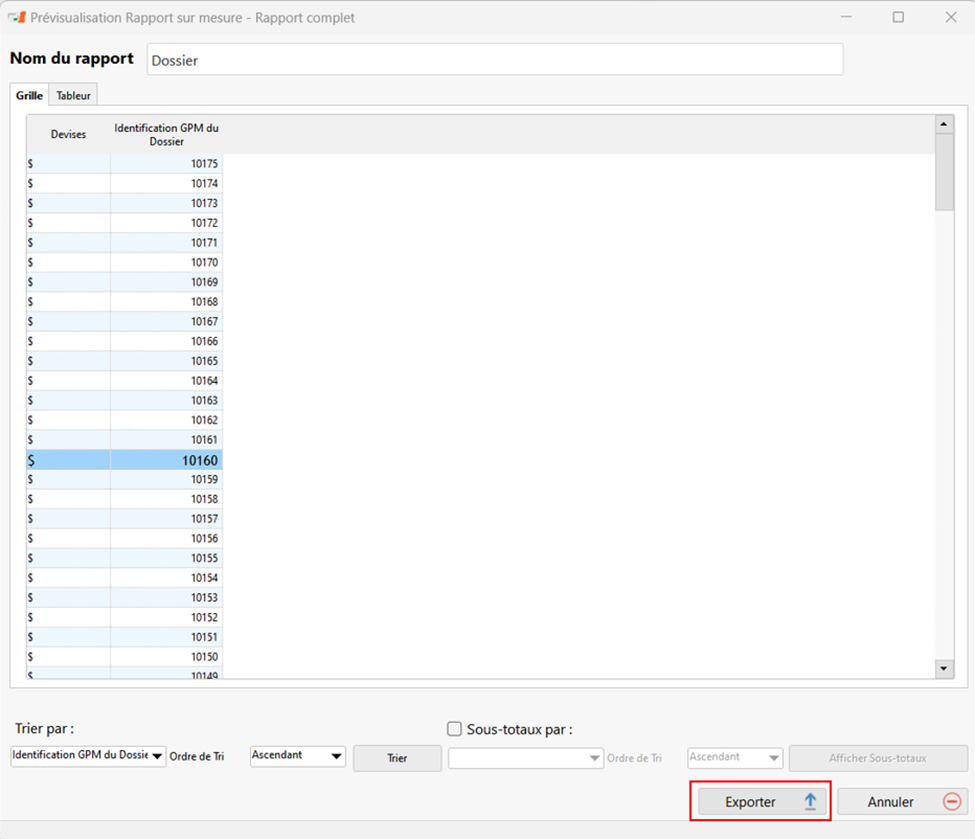

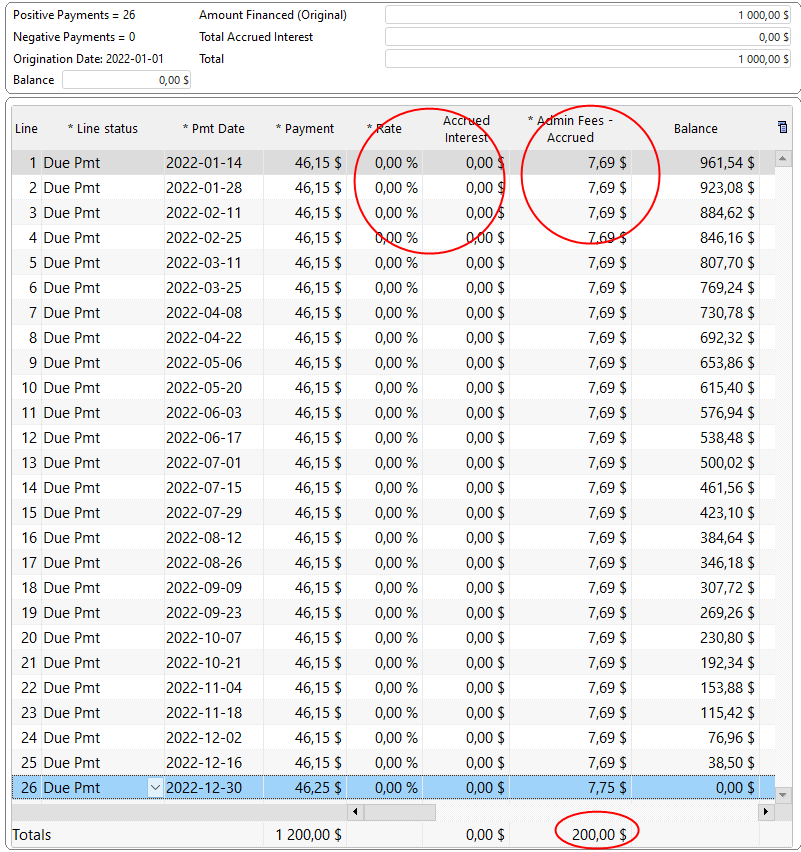

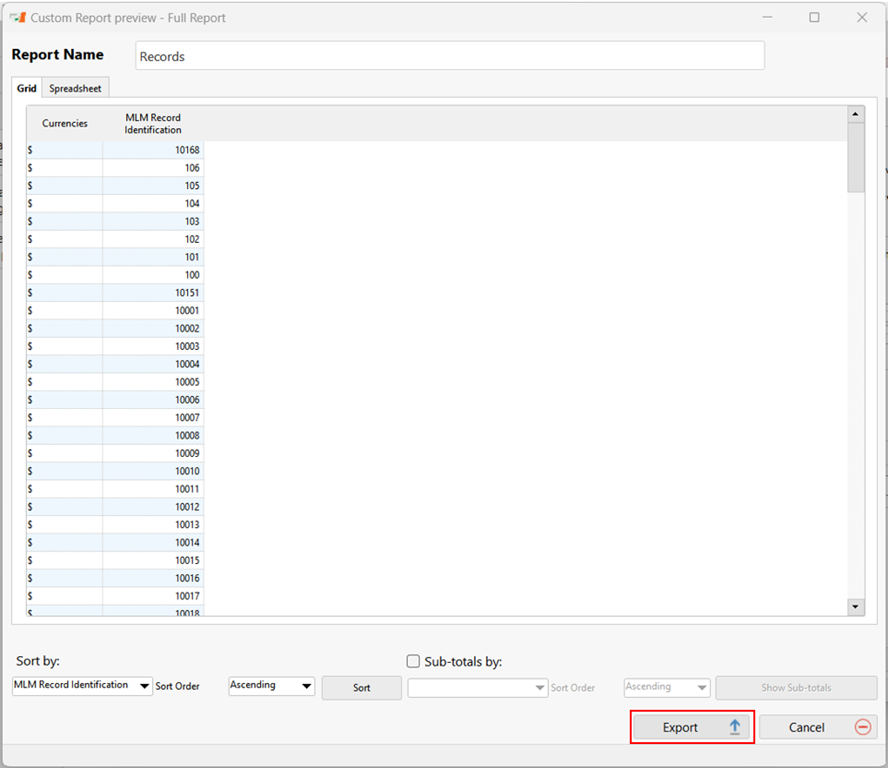

Once this field has been created, you can import your invoice numbers. To do this, you will need a list of your Record unique identifiers. You can create this list in Reports > Record List and export in Excel format.

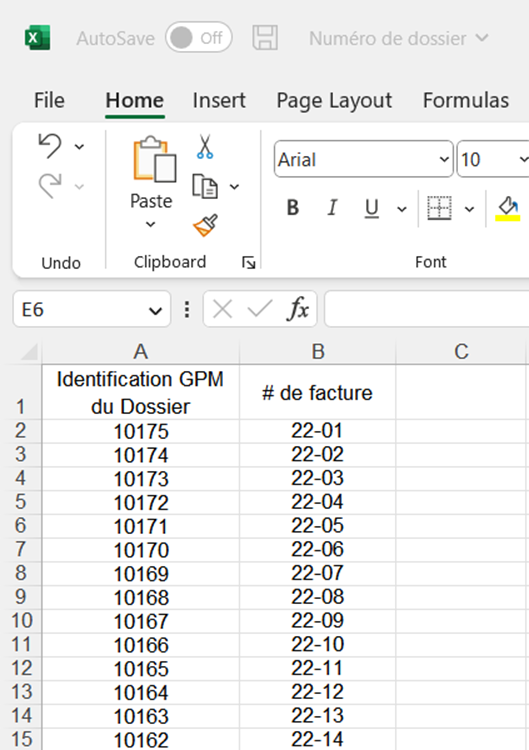

Once in Excel, adding your invoice numbers to the document will be easy.

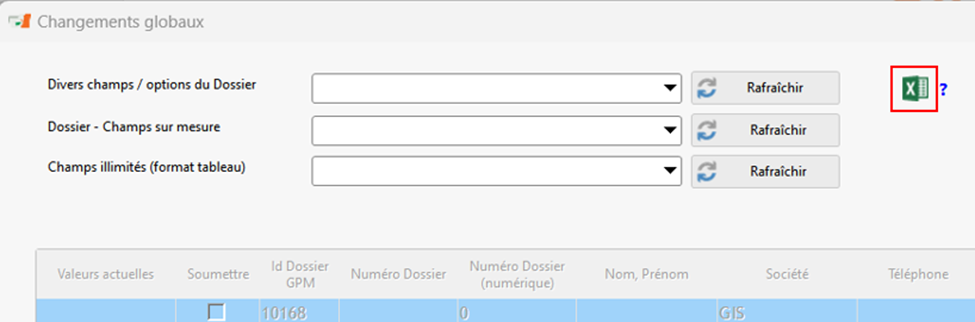

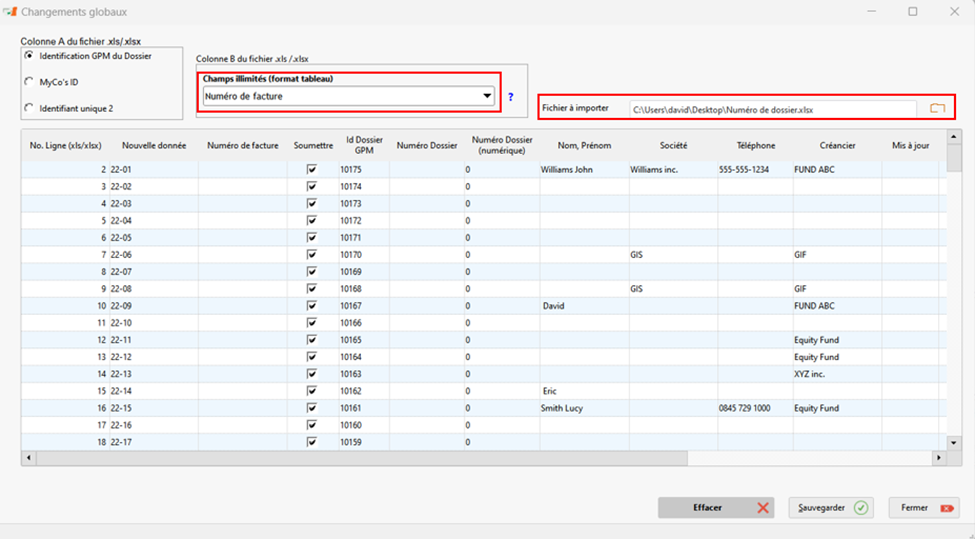

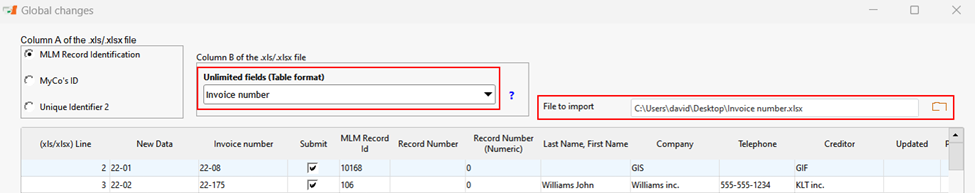

Now let’s update your invoice numbers with the Global Changes tool. To do this, right-click in the Main Margill window and select the Global Changes option.

When the window opens, click on the Excel icon at the top right of the window.

In the new window, simply select the Invoice number field and the file to import.

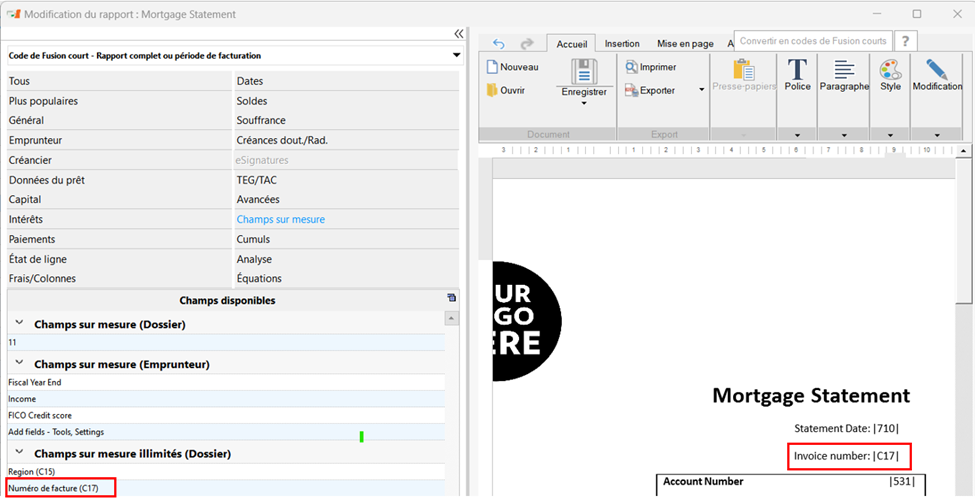

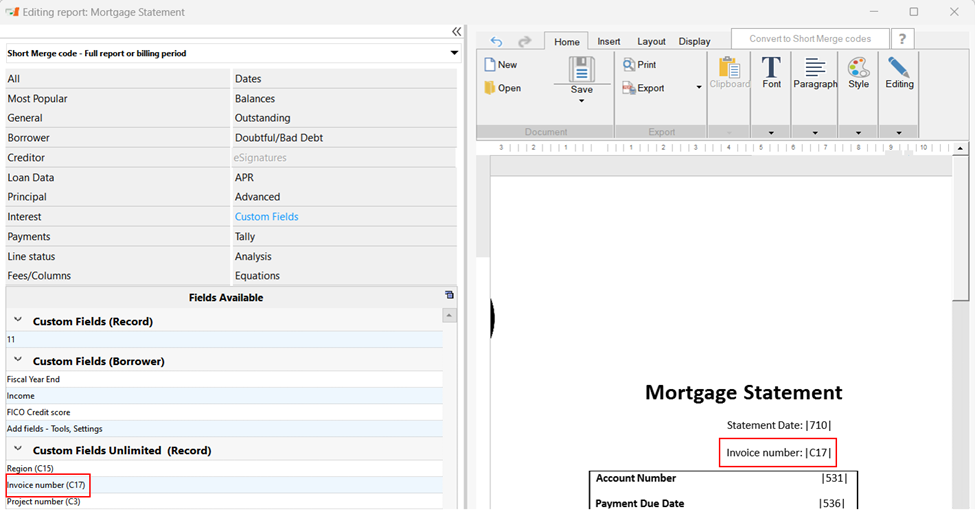

Now, you can add this field to your invoices and account statements.

Before the next billing cycle, you must import the new invoice numbers in a new field (with year and/or month) or in the existing field (the invoice number will thus be updated at every new billing cycle).

Second method:

You will find that this method is faster and requires fewer manipulations. On the other hand, you will not have the same flexibility as the previous method.

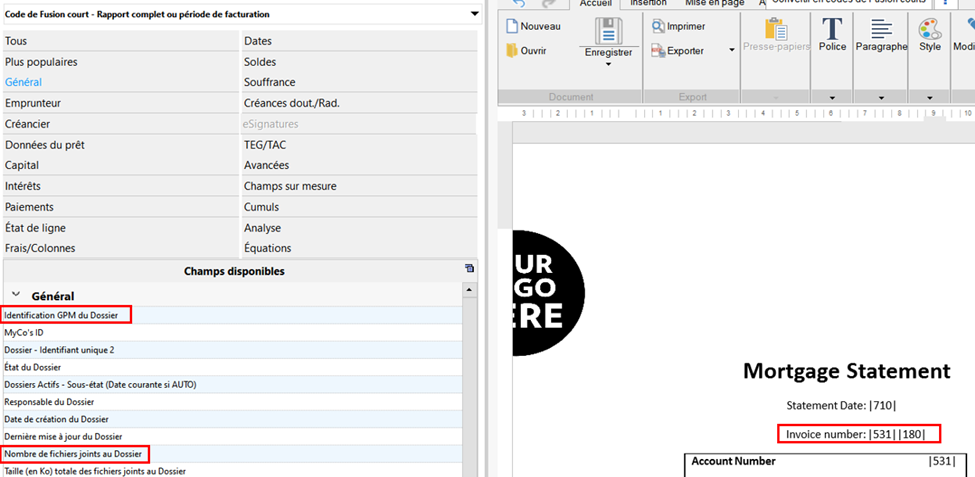

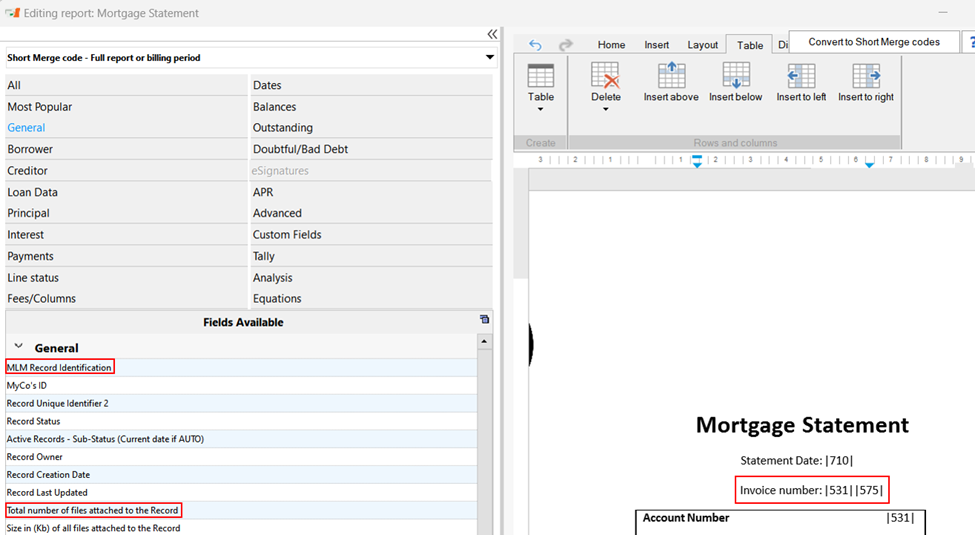

This method consists of creating a unique invoice number using the MLM ID and, for example, the number of documents attached to the Record. Several other options would be possible such as adding a date or other.

To do this, add the following fields to your invoice:

1- MLM Record Identification

2- Total number of files attached to the Record

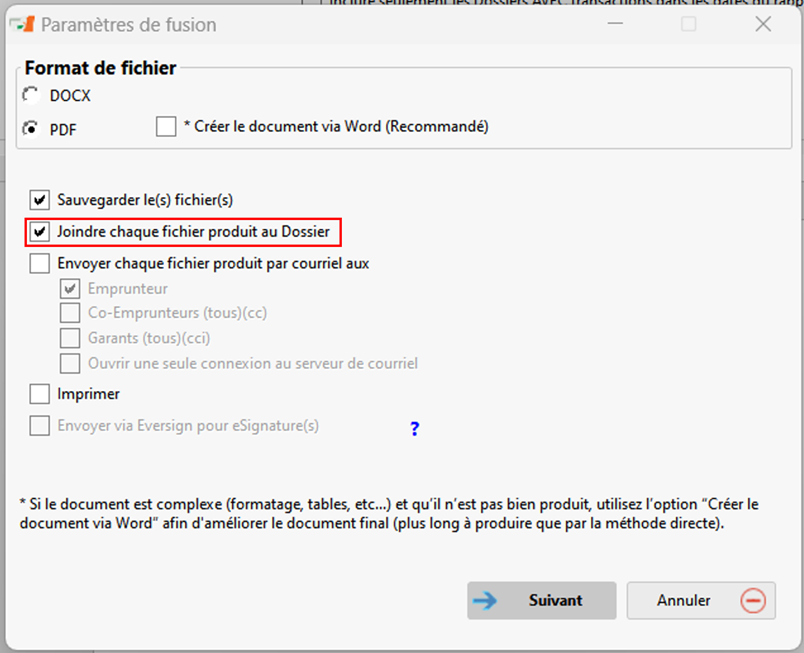

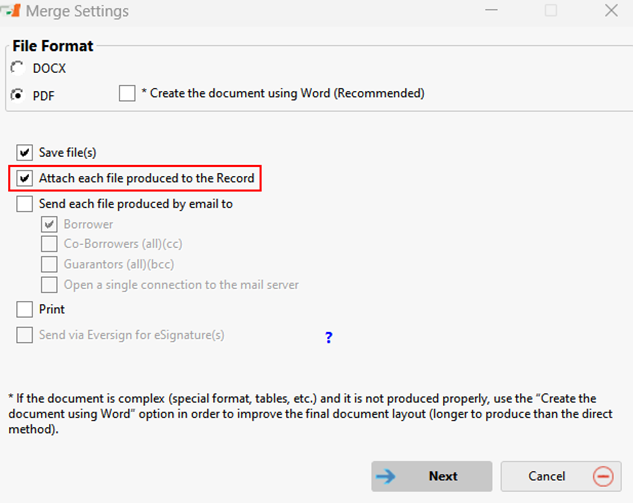

When you produce your invoices, it will be important to check “Attach each file produced to the Record”, so that the numbering continues correctly.

It is up to you to see which technique is preferred to obtain the desired results. Note that it is possible to combine the two techniques. Do not hesitate to contact our team if you have any questions regarding the Document Merge function at [email protected].