Question:

How to set Global Initial Fees which are a) a flat $100, b) a Dealer Fee of 7% of the loan amount and c) an Admin one time initial fee of 7% of the loan amount. These fees are financed, not paid up front…

How and where do I set the Initial 3 fees described above and can I have them only apply to “Auto” loans, but not to other types of loans?

Answer:

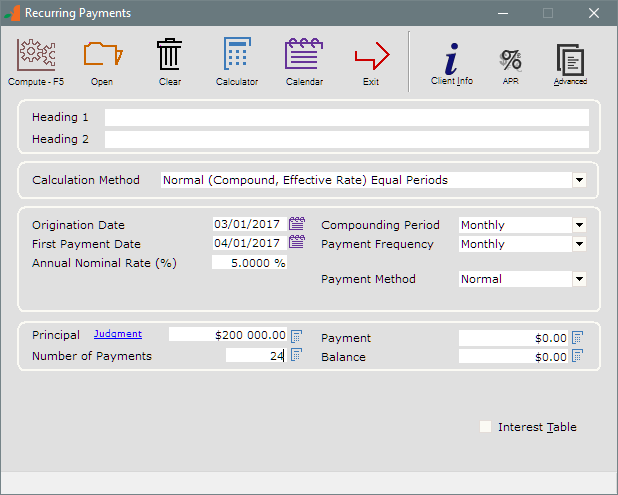

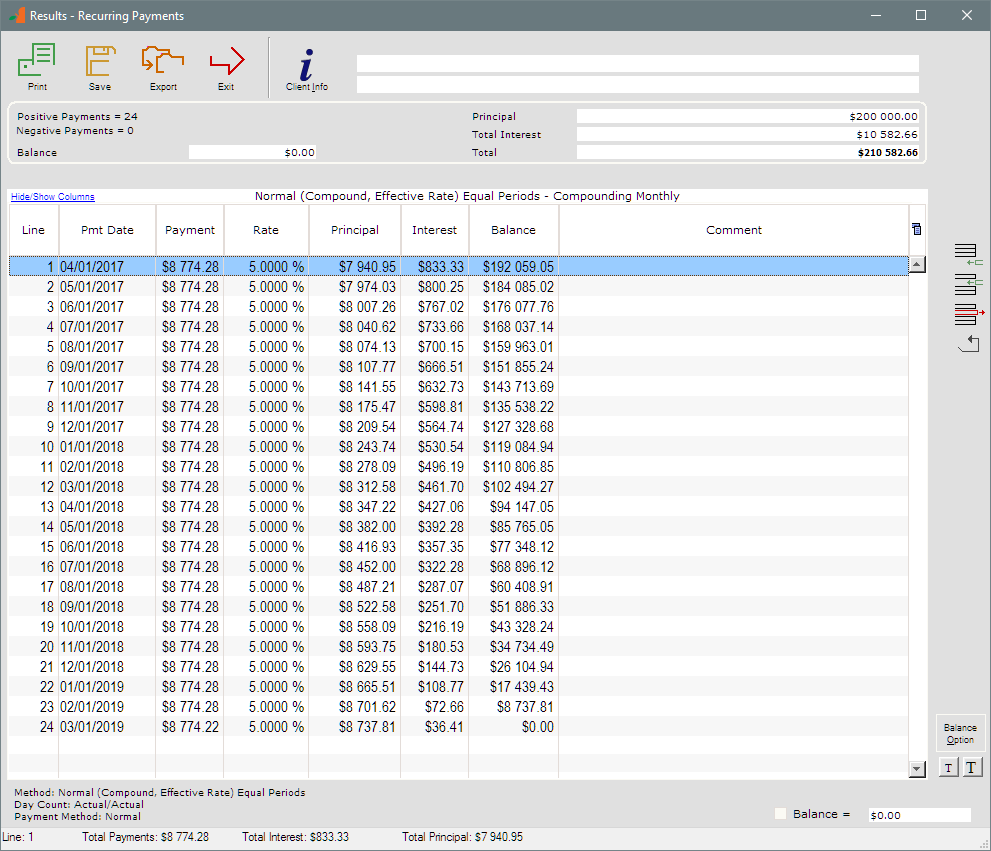

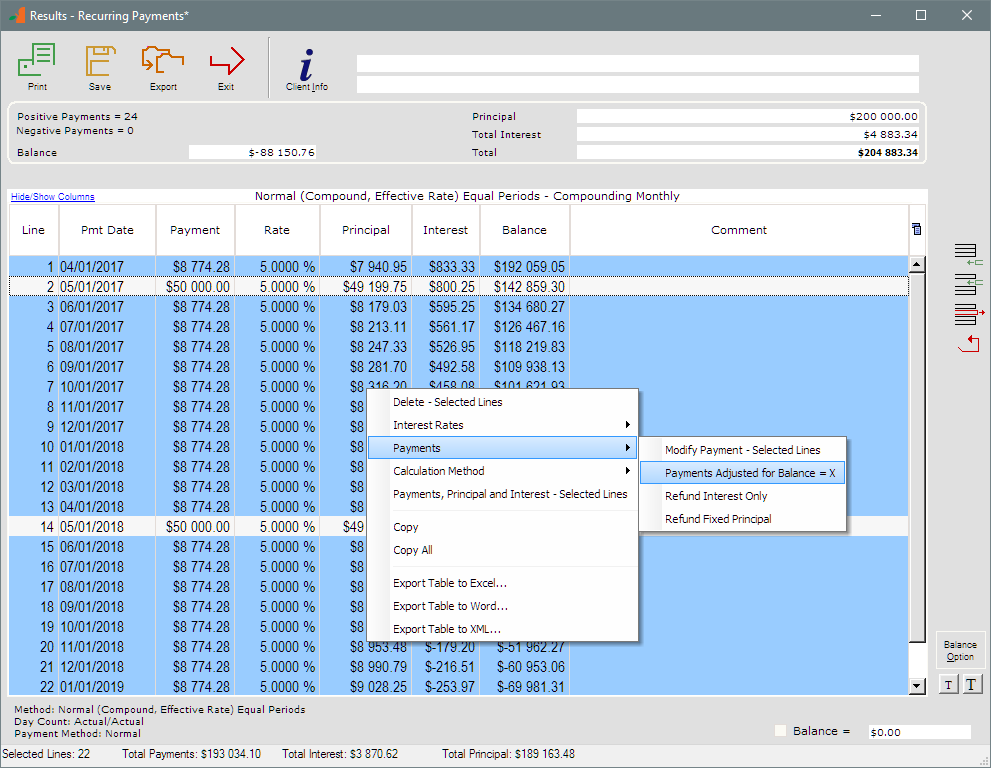

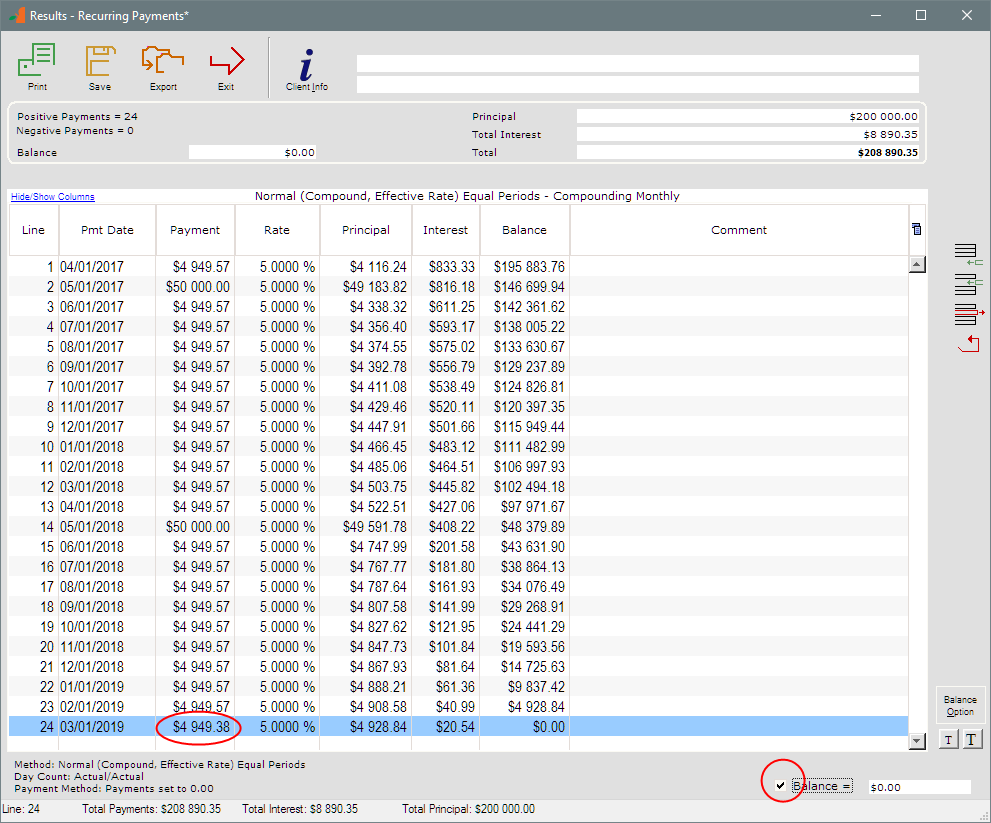

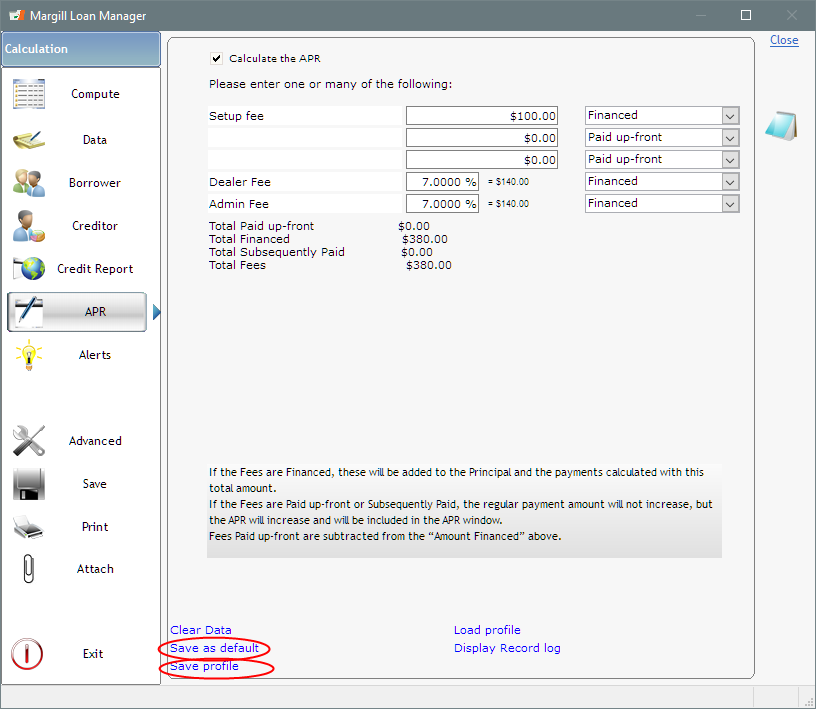

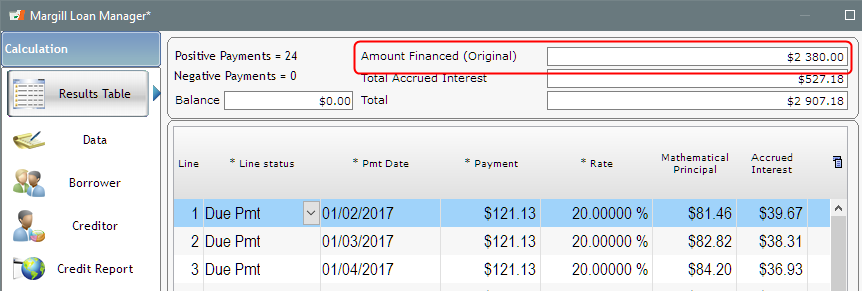

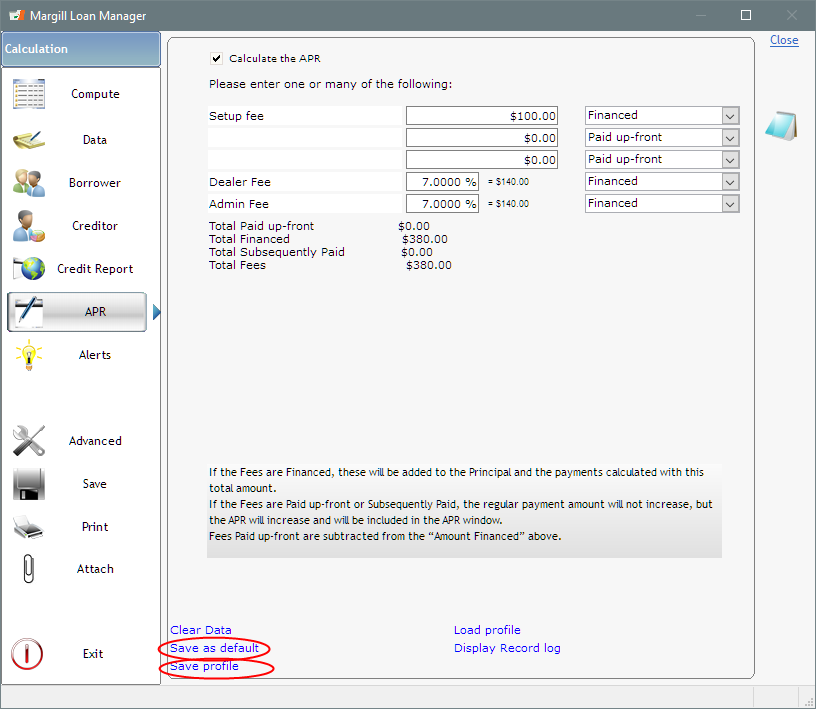

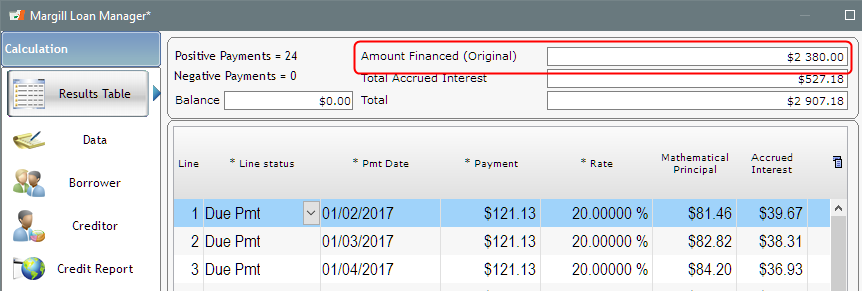

There are many ways to do this in Margill. I would recommend the APR tab. In this example we are looking at a $2000 loan (so the percentage fees are computed to $140 each):

Notice on the bottom left (circled in red) that you can set this up as your Default for all new loans.

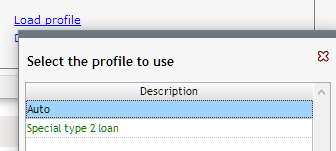

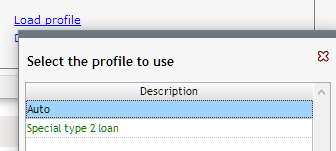

To answer the second part of your question, can some fees apply only to some loans? Yes. You can save what are called “Profiles”. So these fees would not be set up as the Default but as a Profile for Auto loans.

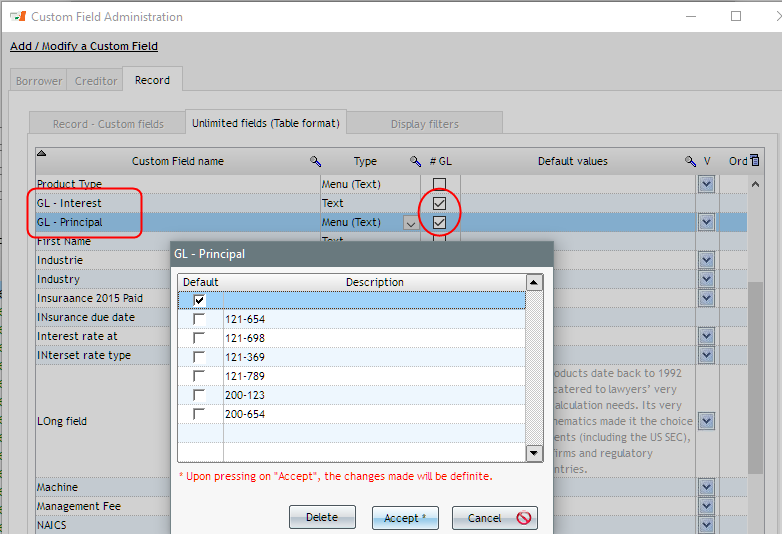

APR fees financed and accounting

Since these three fees are financed, they become “principal” like (part of the total amount financed).

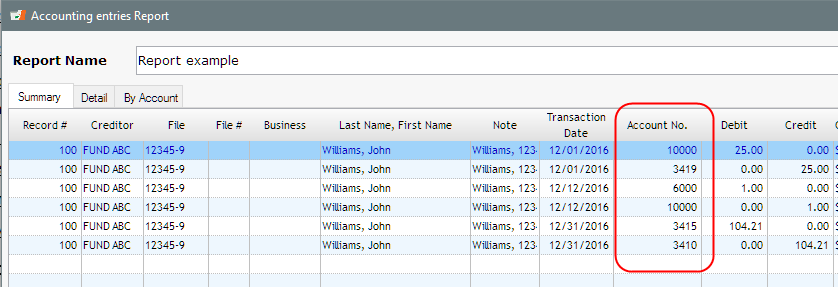

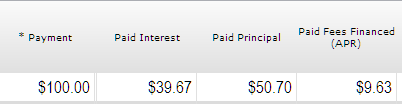

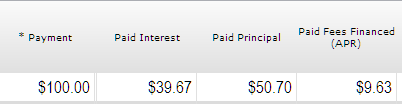

So when they are paid, from an accounting perspective, they are paid according to a proportion of 380/2000 (total fees divided by principal): 380/2000 = 0.19

So for a $100 payment, interest is first paid, followed by principal in the following proportion: 50.70 x 0.19 = 9.63

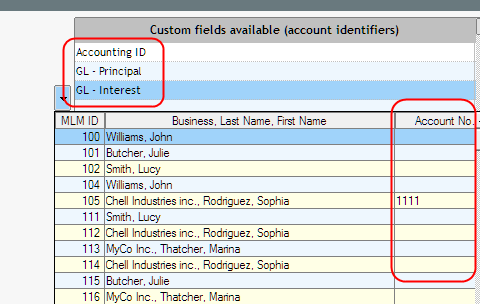

The $9.63 in paid APR fees can even be subdivided by the 3 fee types you entered. This is done in the reports.

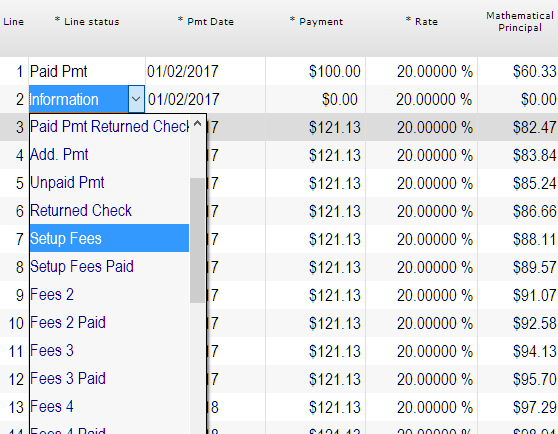

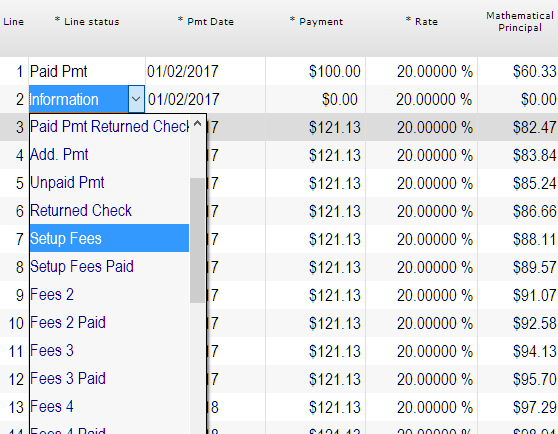

Fees could also have been added as Line Fees and paid when you want then to be paid. You charge fees (“Setup Fees”: -$100 in the Payment column) and you tell the system when you want them to be paid (“Setup Fees Paid”: +$100 or other amount in the Payment column). Each of the fees below can be renamed.

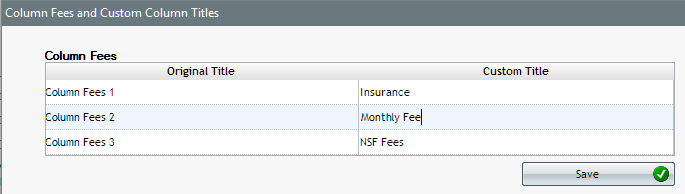

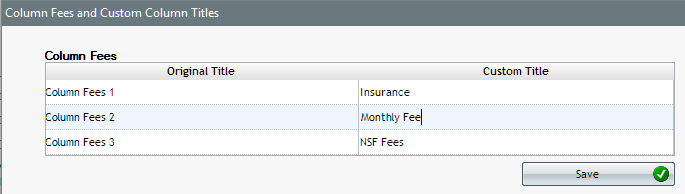

They can also be added as Column Fees that are paid within the normal payment. I personally would keep my 3 column fees for regular monthly fees or for automatic NSF fees…

Conclusion:

Where to add these fees? I personally would add them under the APR tab. You must provide the APR to your borrower anyways…

From an accounting perspective though, although a little less important, you should ask your accountant.