Welcome to our new clients

The Margill Team would like to welcome new users of Margill Loan Manager:

The Margill Team would like to welcome new users of Margill Loan Manager:

Q: Is there an audit trail that can be printed to show transactions / changes to records on a daily basis?

A: Yes very easily.

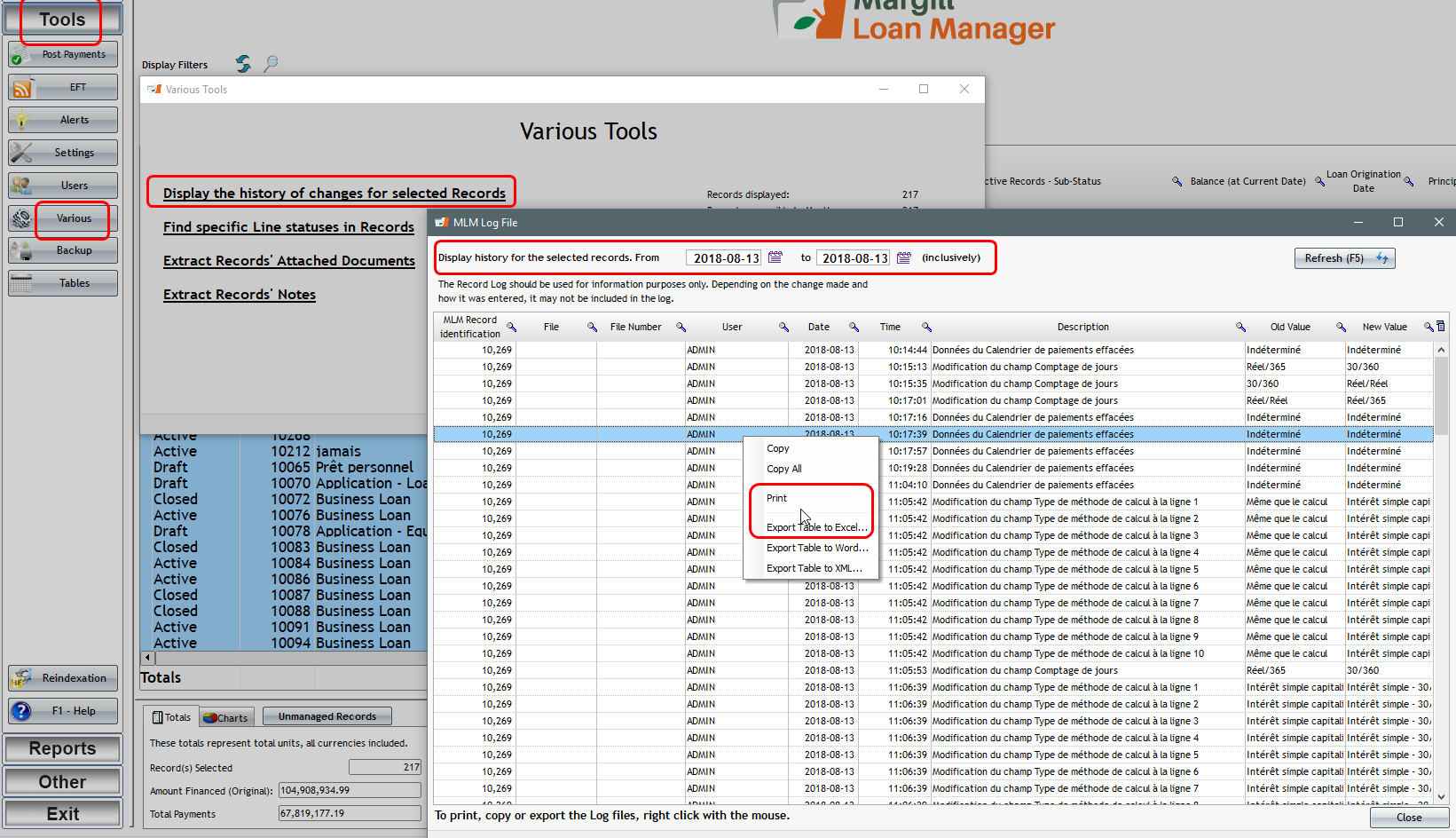

Go to the Main Margill window, select all the loans (probably only Active loans) , Tools > Various > Display the history of changes for selected Records.

You can then right click with the mouse to see the changes for the day, yesterday or any period of time.

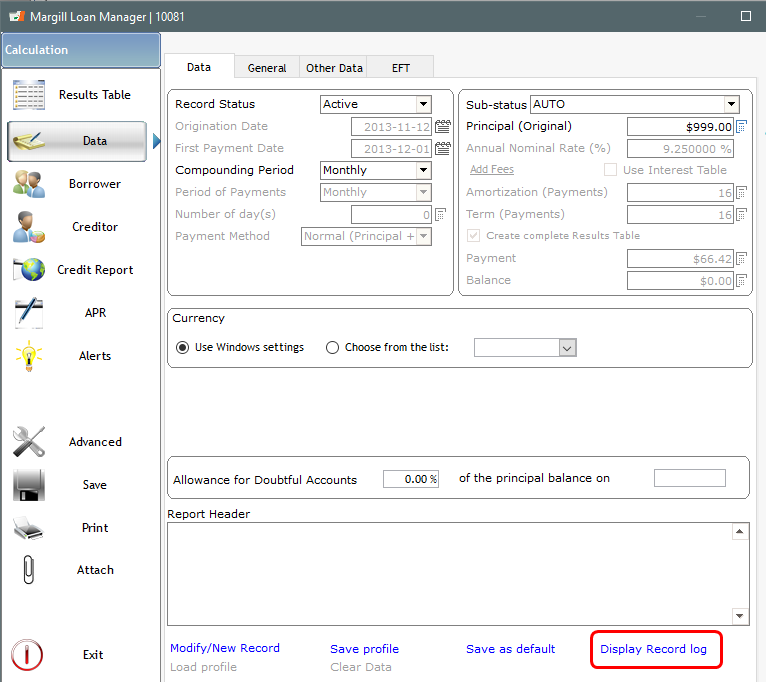

You can also see the log of changes loan by loan in the Data window of each loan:

Q: How to obtain the daily interest amount (per diem) in Margill Loan Manager?

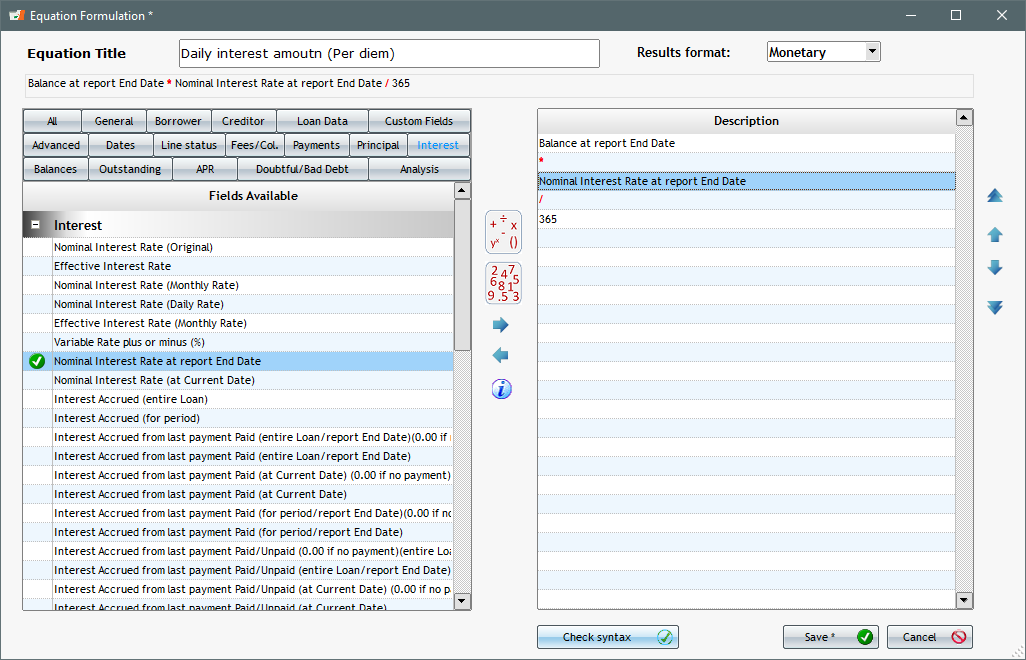

A: This can be added very easily through a simple Mathematical Equation.

Go to Reports > Equation Management and click on

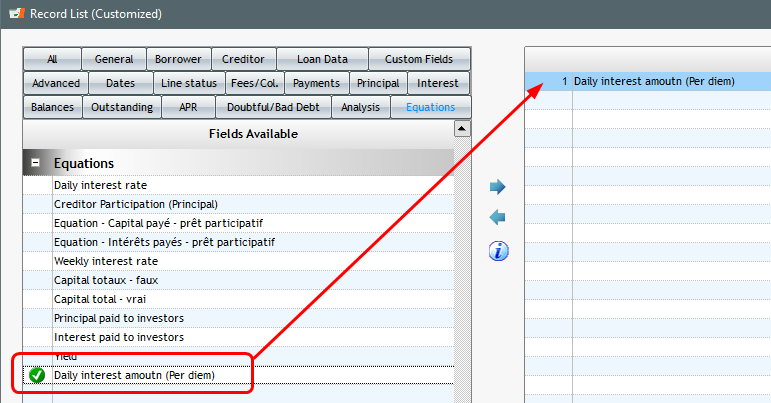

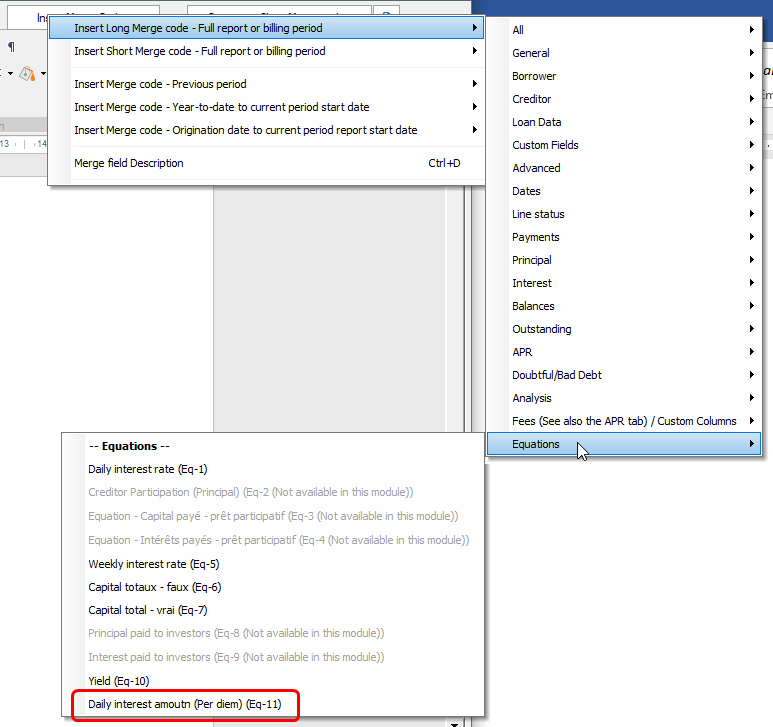

You can now use this simple interest Equation in various reports picking it up in the Equations theme:

Record List Customized:

Document Merge (DOCX., RTF, PDF) for your Invoices and Statements:

Question:

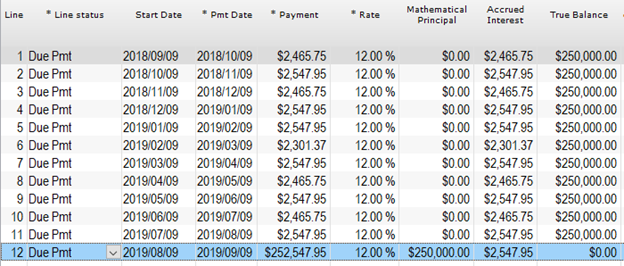

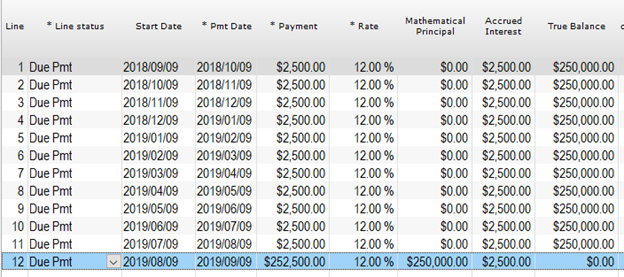

My company does interest-only 12 month bridge loans calculated in two ways.

Can these two calculation methods be done in Margill?

Answer:

Yes.

In Simple interest, Margill will usually use the exact number of days in a month and in a year to compute the interest. The Day count would be Actual/Actual (or Actual/365 or Actual/360).

If the interest is to be the same every month, the use the 30/360 Day count which simulates months that are of the same length.

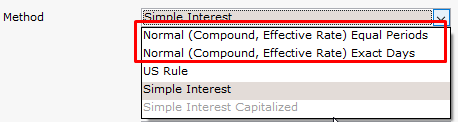

For Compound interest (what is called the Effective rate method – the banking method), there is an extra calculation method option that calculates using the exact number of days and another that splits payment in equal periods. The Day count does not have to be used to “artificially” simulate the equal periods.

We are proud to have another new user for the Margill Loan Manager Software. Texas Mortgage Finance just joined the Margill family. You can visit their website here.

The Margill Team

Question:

I was wondering who I could contact at Margill for help on calculating a rather complex amortization table.

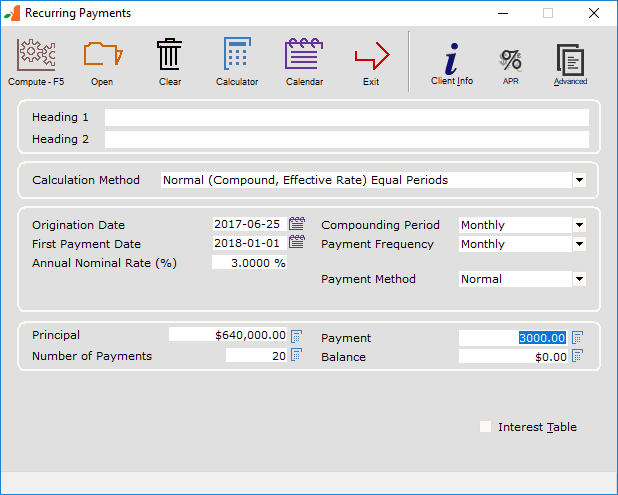

Beginning on 6/25/17 – the principal loan amount was $640,000 at an interest rate of 3% – payments of $3,000 to begin on 1/1/2018.

Answer:

Actually quite simple:

Go to “Recurring Payments” calculation. We will suppose this is compound interest, compounded monthly and monthly payments since it is a loan.

Let’s suppose 20 payments of $3000 each (if payments are missing or if there are too many, you can add or delete after).

Enter the data below:

Then Compute or F5.

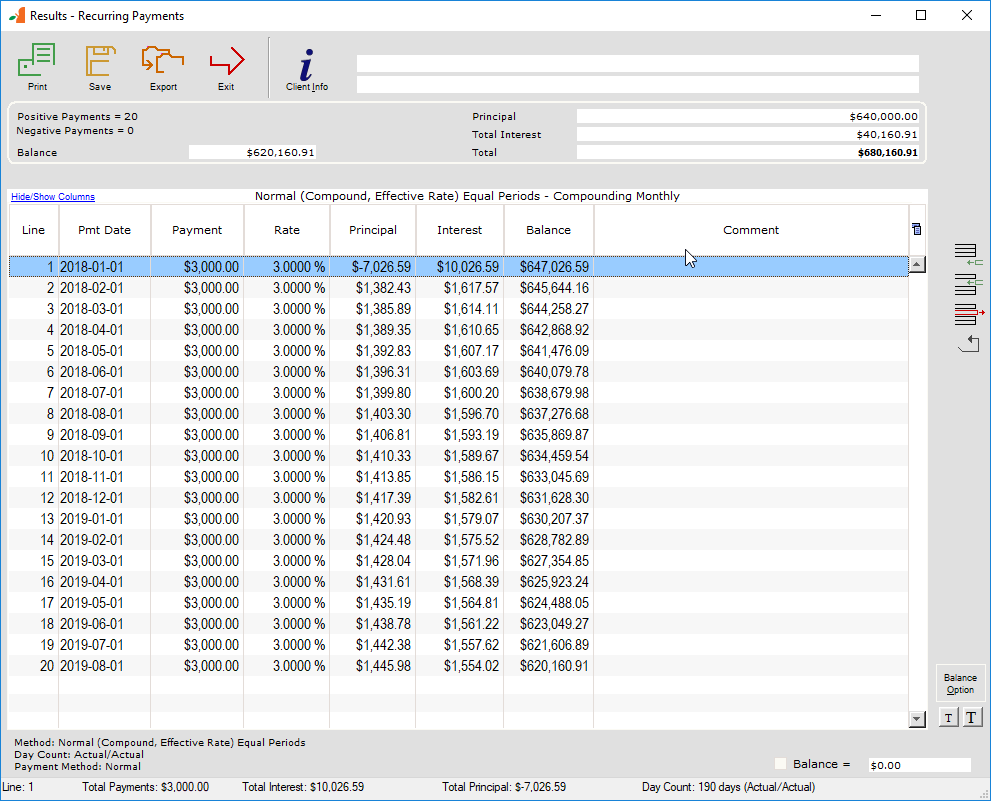

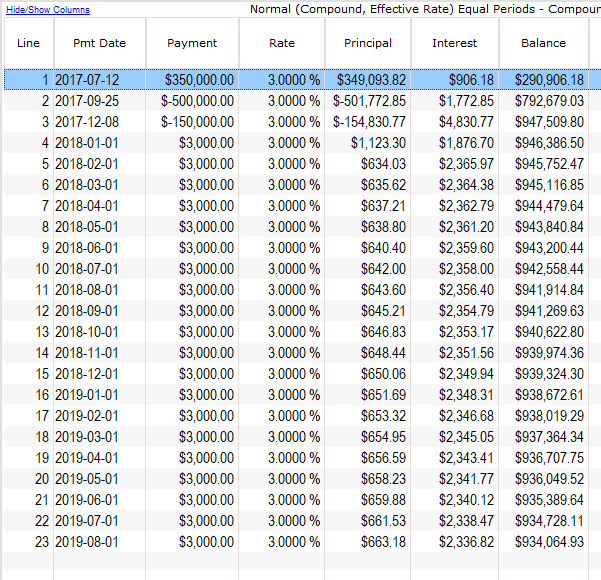

This is our preliminary schedule:

You can now edit the schedule by adding the lump sum payment and extra principal.

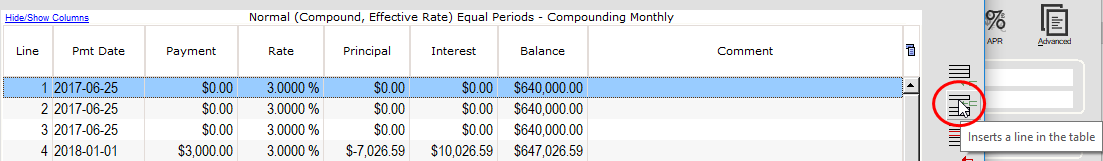

The payment and extra principal were made in 2017 so I should add three lines above my payment date of 2018-01-01

I can do this with this icon or the right mouse click:

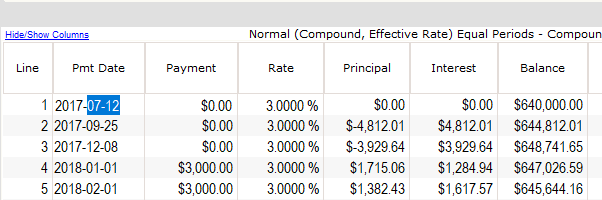

Then change the dates – start with Line 3 since you must follow the chronological order:

And finally change the amounts (1 payment and 2 loans). Notice lines 2 and 3 are negative since we are adding principal.

Now of course, with a balance of 934,064.93 after 20 payments, we would need to add a bunch of payments to fully pay back. You could add these lines with this icon (we would need to add hundreds of payment since payments are quite low):

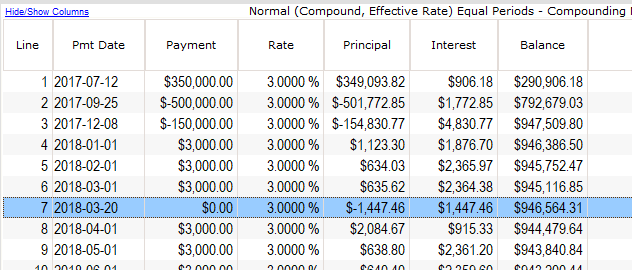

My guess is you are looking for a balance at a specific date (let’s say today, start of day). Insert a line with a 0.00 payment:

And there you have it.

We would like to welcome the Nevada Western Interstate Commission for Higher Education (WICHE) as a new user of our Margill Loan Manager software.

The Western Interstate Commission for Higher Education is a regional organization created by the Western Regional Education Compact and adopted in the 1950s by Western states. WICH was created to facilitate resource sharing among the higher education systems of the West.

You can visit their website here.

The Margill Team

The Margill team will exhibit at the LendIt Fintech USA 2018 Conference at the Moscone West in San Francisco, California. Come visit us at booth number 1649 from April 9 to the 11th, 2018.

The Bank of Canada raises its base rate by 0.25% effective January 18, 2018.