Is there a limit on the number of notes that can be tracked at one time?

Not really. The number of loans you can enter in the system is based on your license package. Our largest users have 30,000 loans, our smallest maybe 5? Price is based on number of loans and users.

Can the interest rates adjust as the Prime rate (or other) adjusts and payments recalculate automatically?

You can update all your loans at once with the Prime rate (or other). You can have interest-only payments recalculated. You cannot have P&I payments recalculated automatically although this feature could be added.

Can the system handle balloon payments?

Yes

Terms of the notes can be different? Interest rates fixed vs variable, length of loan

Yes

Types of reports available?

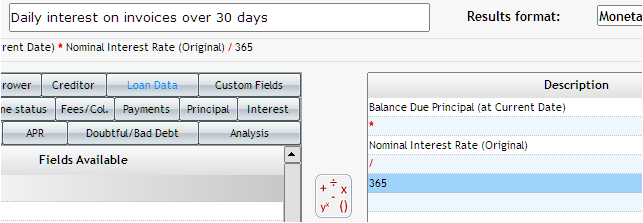

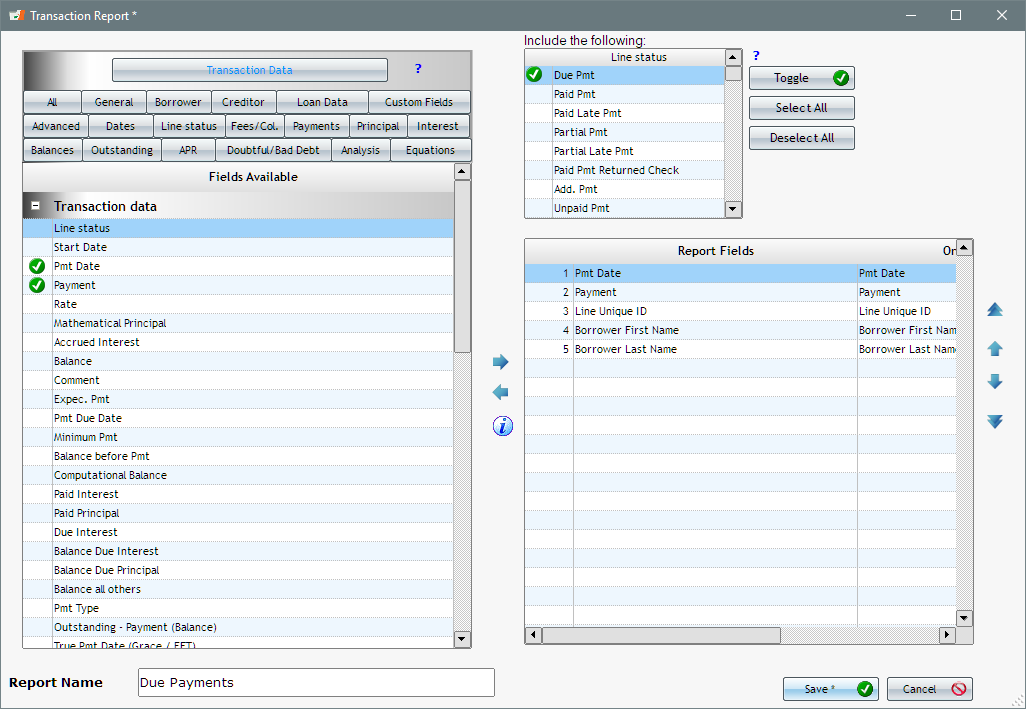

You create your own with over 1000 fields. Various types are available:

- Executive summary including graphs

- Record list (where you chose the fields to report on – name, interest, principal paid, balances, outstanding amounts, etc.)

- Record list with period breaks (totals by month, quarter or year)

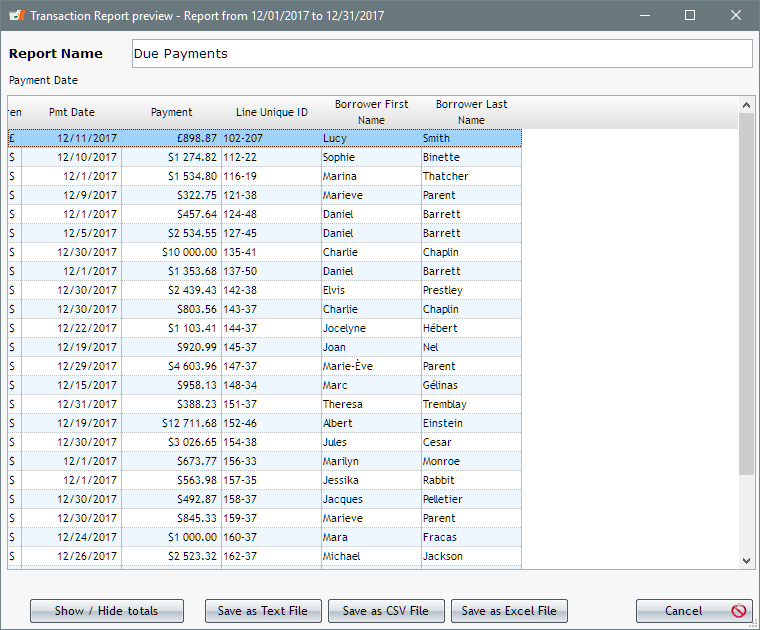

- Transactions report

- Accounting report to send transactions directly to your General ledger with Excel, CSV, TXT, QuickBooks, Sage.

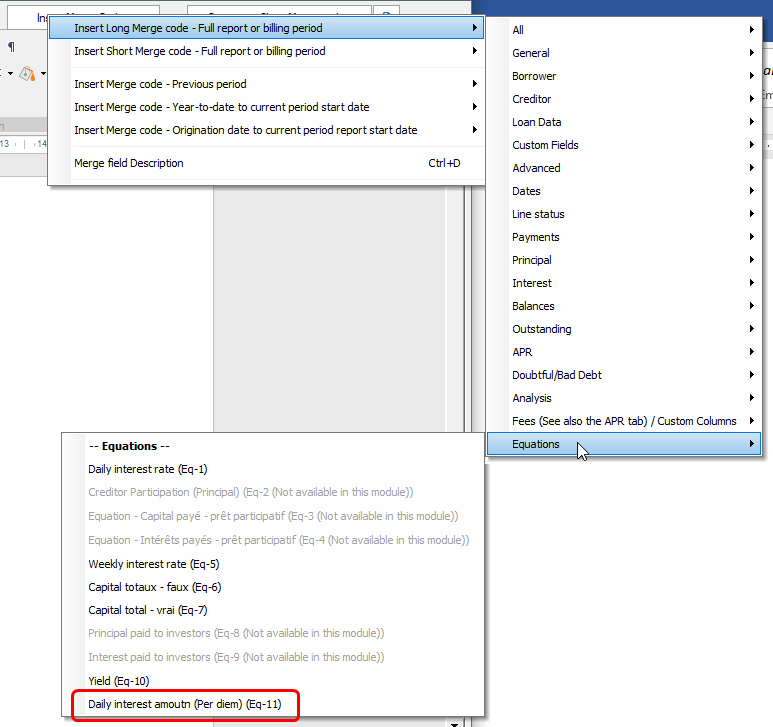

- Merge documents to create invoices, statements, contracts, letters

Reports customizable?

Yes, see above

Able to customize reports on own or does the software company have to do it?

You customize, see above.

The Margill team can also create very specialized customized reports if needed.

Able to track short term vs long term portion of notes?

Yes

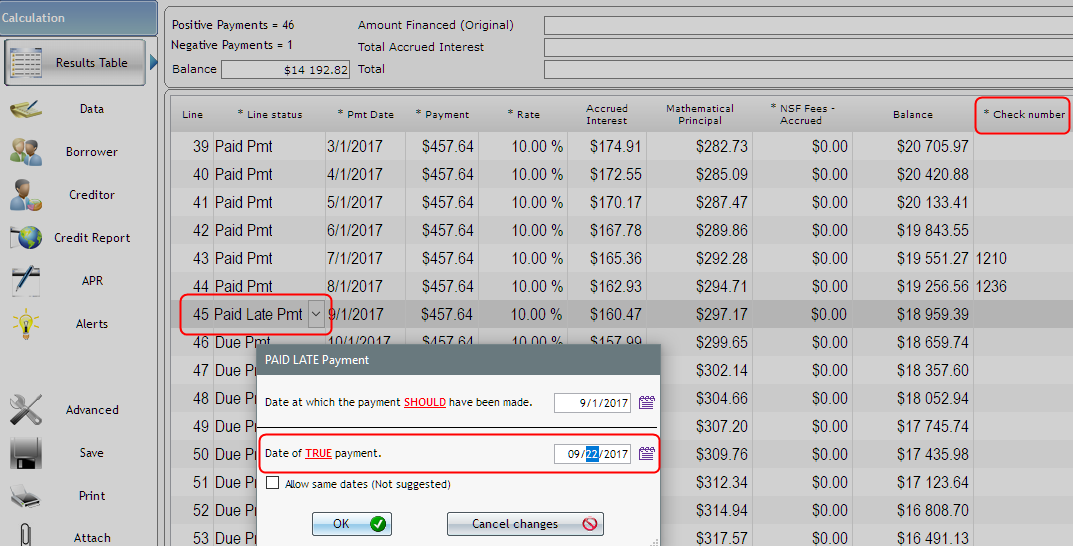

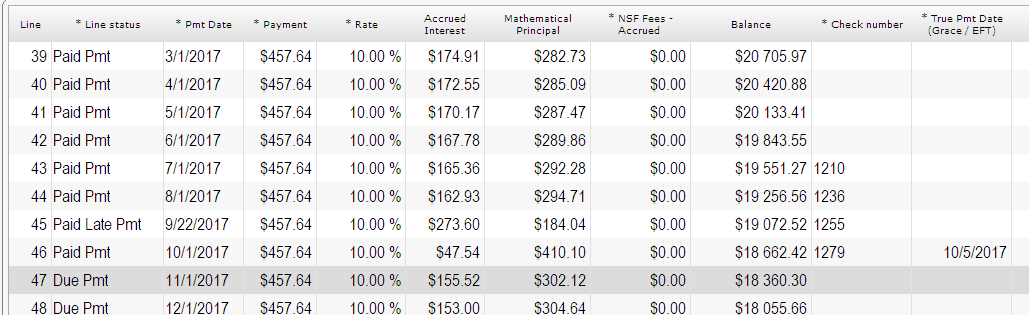

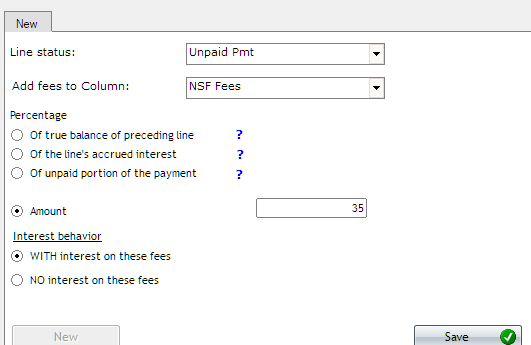

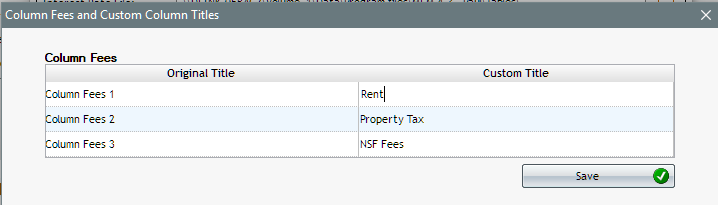

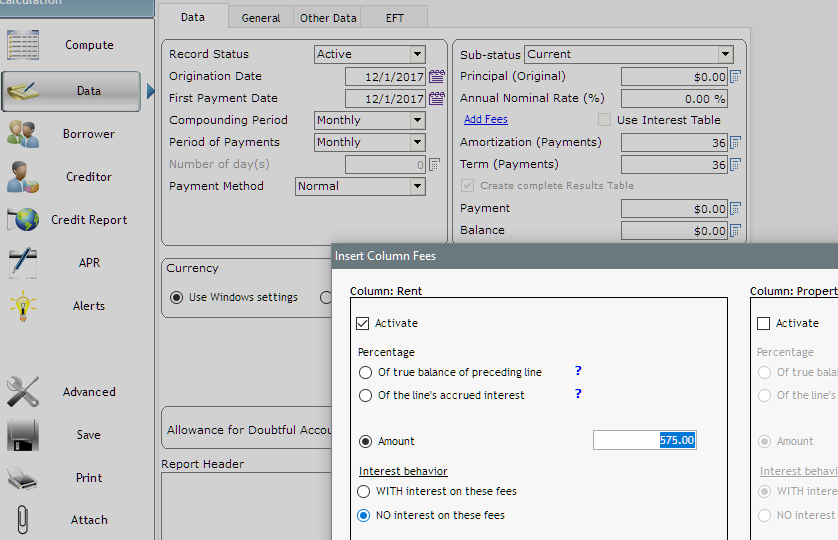

Able to assess late payment fees automatically after a specific grace period?

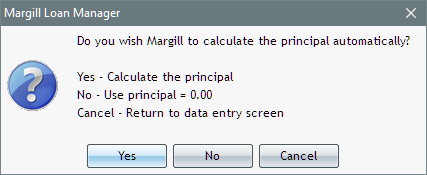

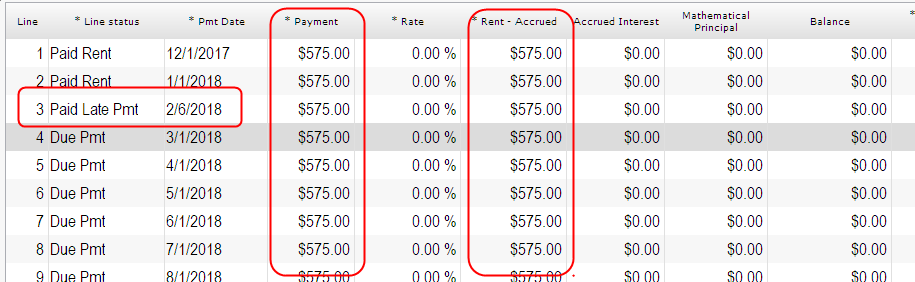

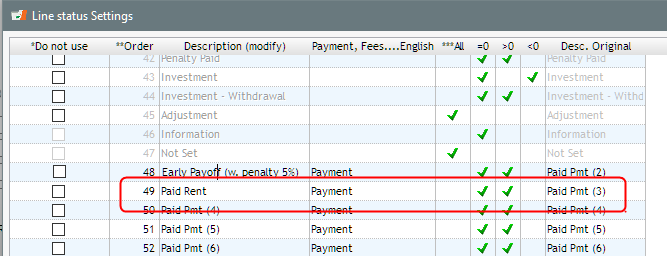

No and yes. You can configure Automatic fees but a human has to tell the system that the payment is paid on that date (10 days late for example) and human must change the transaction from “Due Payment” to “Paid late > 10 days” so $x fees apply. You create your own fees rules. Not very complicated actually.

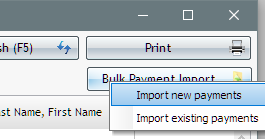

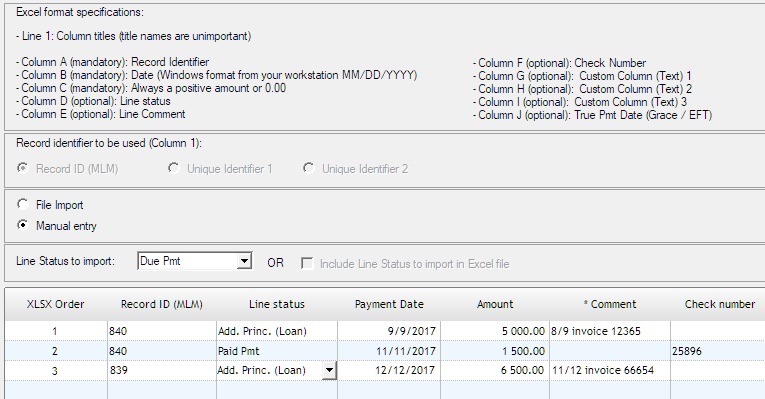

Able to upload payments by csv or excel to multiple accounts at one time?

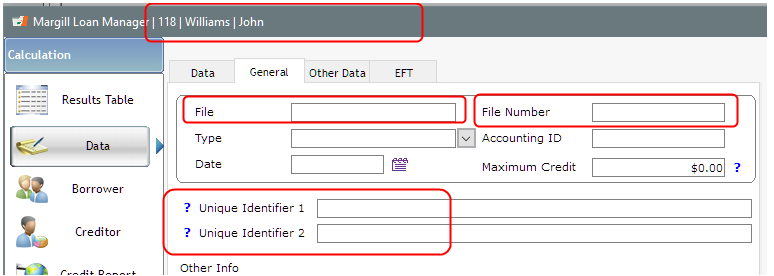

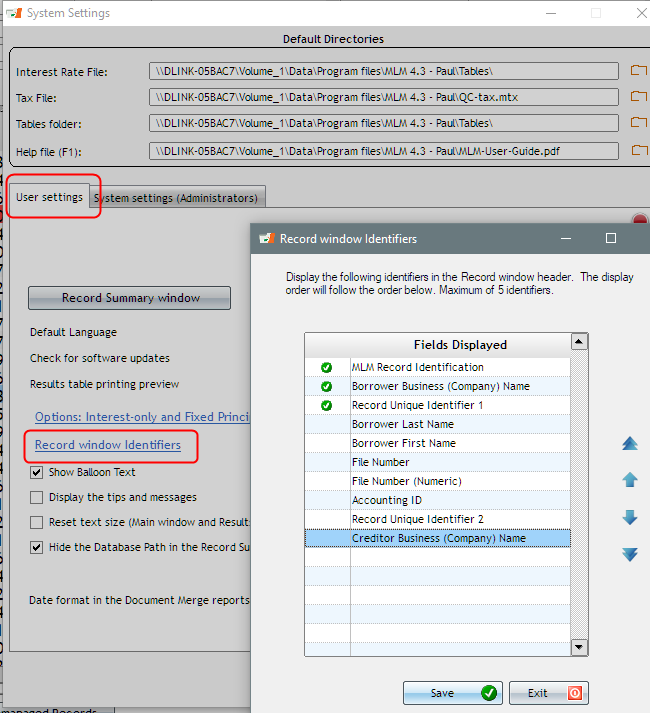

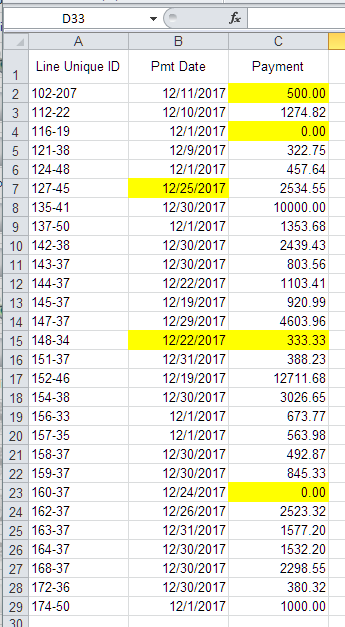

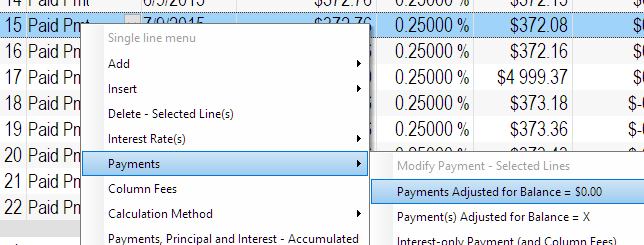

Yes but you need not do this since the schedule already exists. You change a payment from Due to Paid (or Unpaid, Late , Partial….). This can be done in bulk and there is also an option to post these payments via an Excel sheet since every single payment has a unique ID – BUT you have to give this ID to your ERP system or Accounting package in order to post back to Margill after… To be discussed…

Is there a notes section available for collections, etc?

Yes – even automatic emails if, for example there is an unpaid payment, system sends out an auto email: “Dear John, Your payment of $123.45 bounced on November 3, 2017. Please call us ASAP.”

Auto print invoices? Automated email delivery of bills?

Yes but not Auto – a human has to tell the system to send these every month – but yes sent automatically by email with a subject, text and PDF attachment.

Is the software server-based? Cloud based or both?

Server-based but about 25% of our clients use on THEIR cloud. We do not store your data.

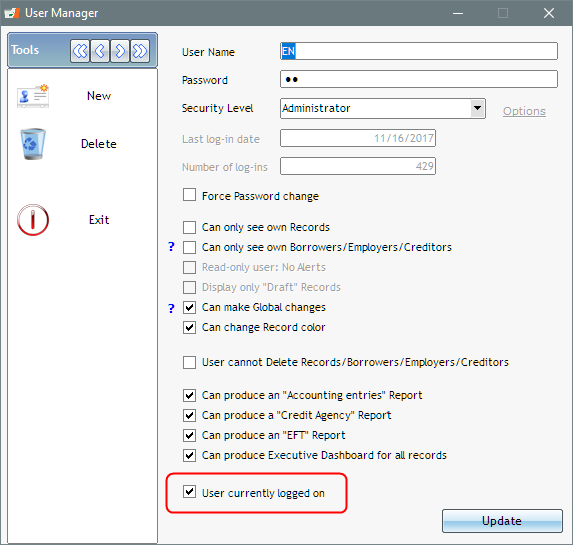

Number of users allowed per license?

No set limit.

Automated payment notification to debtor when payment is received?

Yes by email

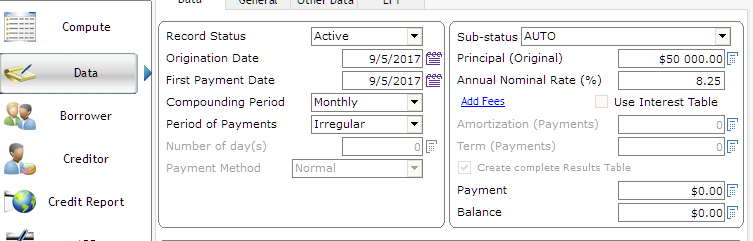

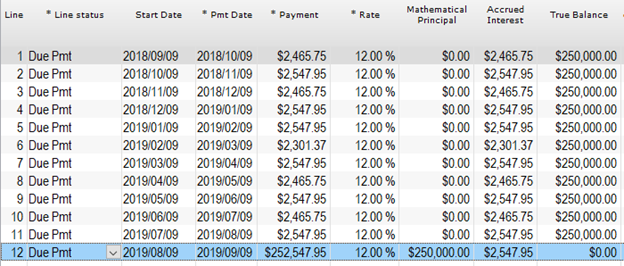

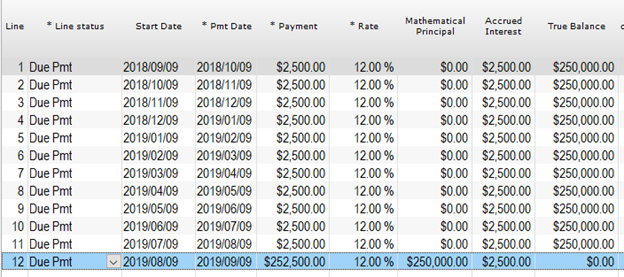

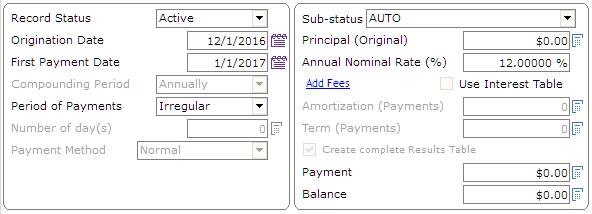

Able to create amortization tables within the software?

Of course!

Able to create loan docs in the software? Example: Promissory Note Agreement If so, able to use our format or required to use software company’s format?

Yes. RTF, DOCX and PDF – this is called Document Merge. You can copy/past your Word document and add images and merge fields.

ACH payment processing available within the software?

Yes

US partner: Intrix (based in Colorado and California)

Canada partner: Perceptech (Acceo) (based in Montreal)

Contract required when purchasing the software?

No except the standard End-User Agreement

Cost of software? Set up fees? Monthly or annuals fees? Per user cost?

Please contact us by email ([email protected])

Here’s a little more information:

Presentation of the software: http://www.margill.com/margill-loan-manager/Margill_Loan_Manager_Overview.pdf

More detail: http://www.margill.com/margill-loan-manager/Margill-loan-servicing-en.htm

Short videos: https://www.margill.com/en/support-center/video-guides

You can also try it for 30 days at http://www.margill.com/ncm

See our client comments: https://www.margill.com/en/client-testimonials/

We can also set up a live demo. Please contact [email protected] or call at 1-877-683-1815 or 450-621-8283.

button

button button

button

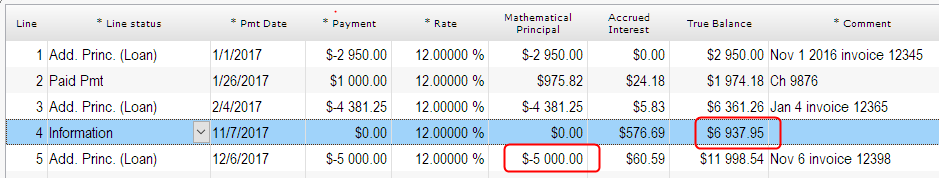

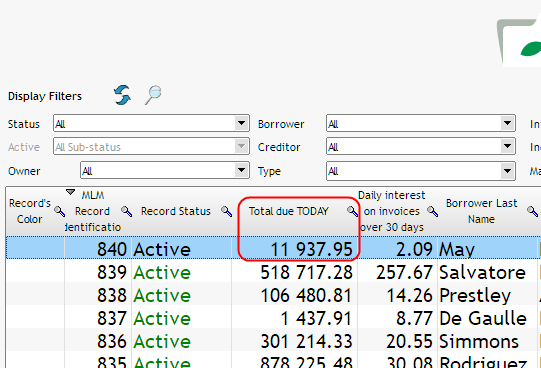

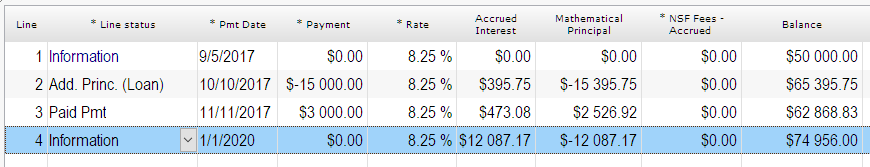

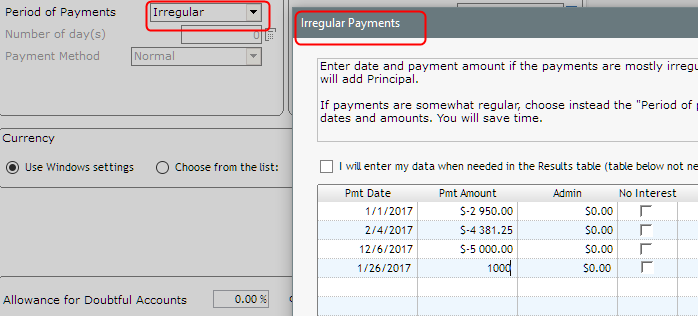

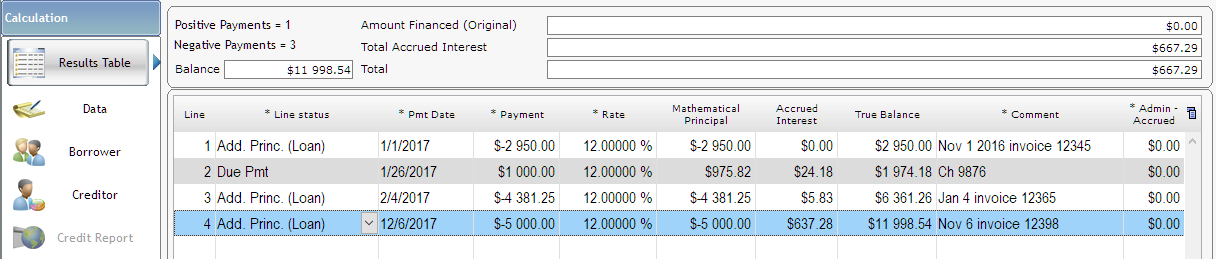

). Change the date to today’s date. So this client owes the law firm $6937.95 + $5000 = $11937.95 but does not YET owe the $60.59 in accrued interest.

). Change the date to today’s date. So this client owes the law firm $6937.95 + $5000 = $11937.95 but does not YET owe the $60.59 in accrued interest.