Seamless Legal/Litigation Fees Finance Management and Interest Calculation for Law Firms with Margill Loan Manager

Many law firms, particularly, personal injury lawyers (accidents, injuries, claims, liability) will finance their client costs and fees until the settlement occurs, at which time they will deduct these fees, costs and now interest, from the settlement amount. With rising interest rates, it becomes increasingly difficult for law firms to finance their clients without charging interest. Money is longer practically free!

Managing this all the while calculating interest can become quite arduous without the proper system. For all the respect and admiration I have for spreadsheets and Excel, these just aren’t made for this (See Loan Servicing with Excel? Pitfalls and alternatives and 12,000 Reasons why to use Loan Servicing Software as opposed to Spreadsheets!).

Margill Loan Manager (MLM) can, using data from with your other systems, create the actual Case (more or less a loan), import case costs and fees (transactions) in bulk, and calculate the interest throughout the lifecycle of the Case. In some situations, a line of credit is afforded to the client where costs and fees (invoices) are added and payments made occasionally by the client to reduce the balance owed. This latter situation does not factor in success/non-success, so is simply client finance.

For litigation finance based on success, if a case is successful, interest will be charged to the client and fees reimbursed. If the case is not successful, no interest or fees will usually need to be paid back by the client, but the law firm will know its cost of capital, case by case. Most often, the cost of capital to the law firm (so the interest rate its bank charges) will be the same rate as the rate charged to the client, but it could also be higher (margin) to generate a little extra revenue. The interest rate could also be fixed or tied to the bank rate (variable interest rate loans) and could include a spread (so Prime + x%). Simple or compound interest can be used as the calculation method.

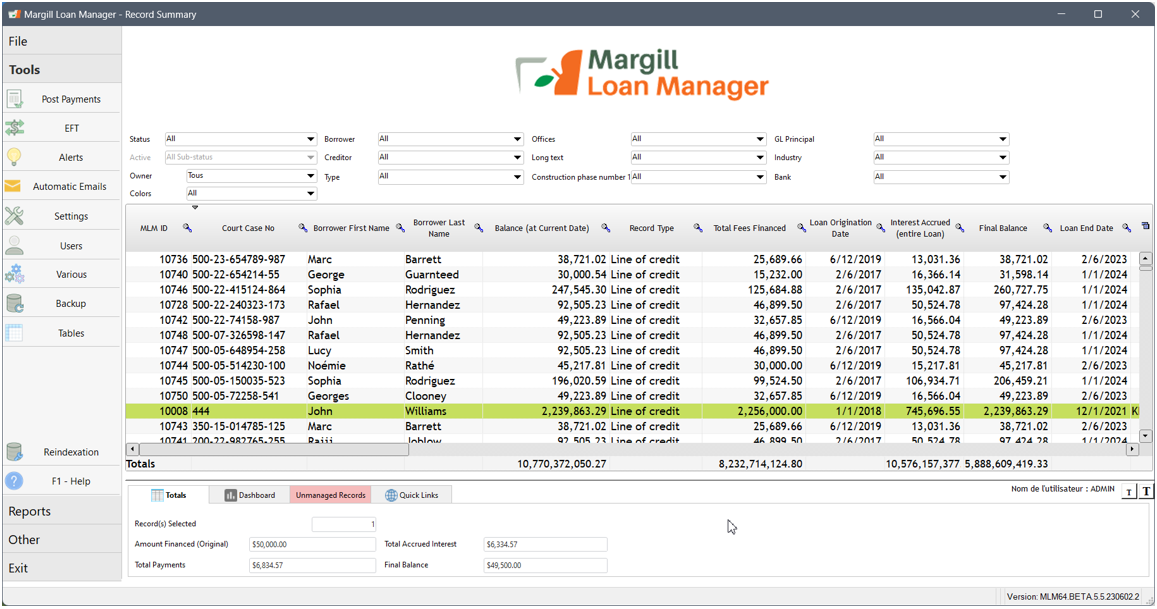

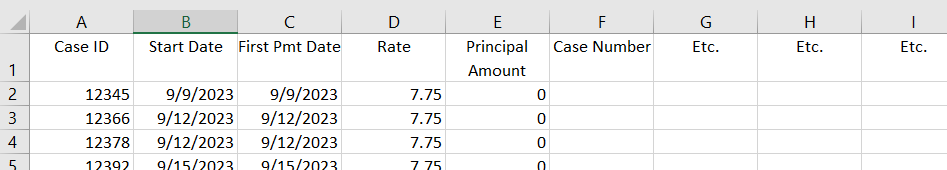

Main window where all cases are shown:

Some interesting aspects:

- A graphic Dashboard can show portfolio trends;

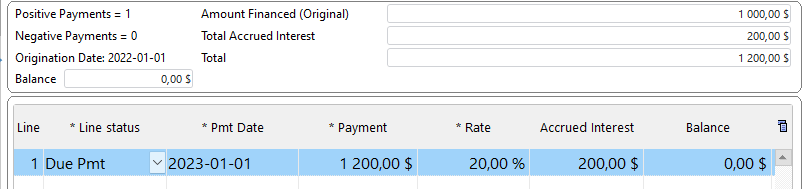

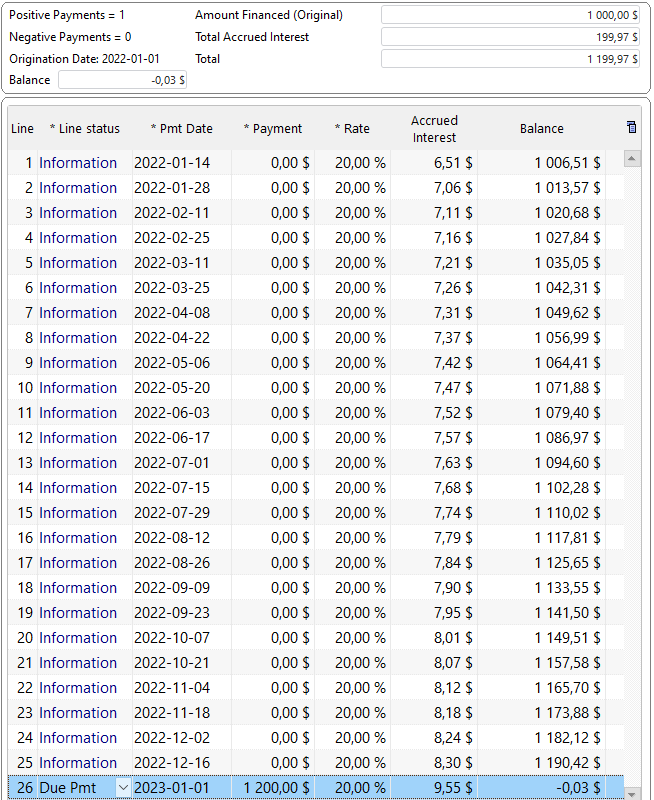

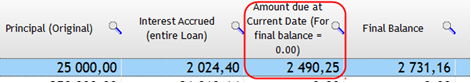

- Balances (principal and interest) are calculated every single day, case by case;

- Client names need not appear (they could be identified simply by a Unique Identifier for added confidentiality);

- Extra data can be added such as Case Type, Court Case Number, Region, etc., for data analysis.

Steps in Margill Loan Manager:

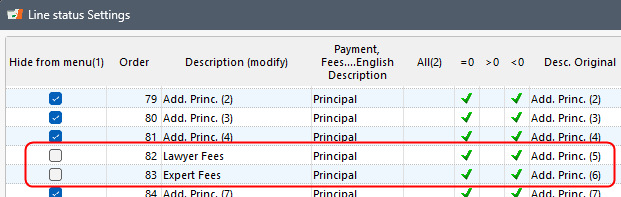

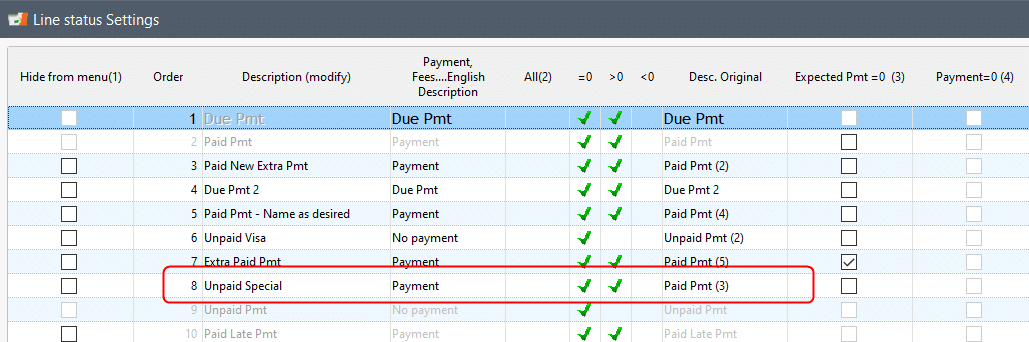

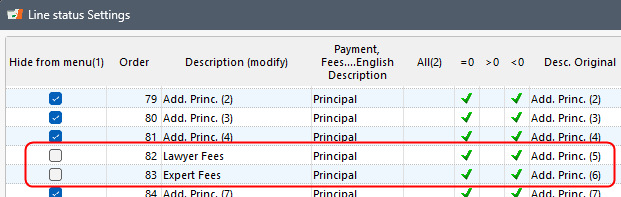

1) Line status setup

We recommend using “Additional Principal” type Lines statuses since we will consider the Fees or Costs to be principal (since this is kind of a loan) as opposed to fees as Margill would see them. So change one or many “Add. Princ (X)” Line statuses to the desired names (Tools > Settings > Line Payment Statuses):

You could create only one “Fee” or multiple fees (up to 9 different names if needed).

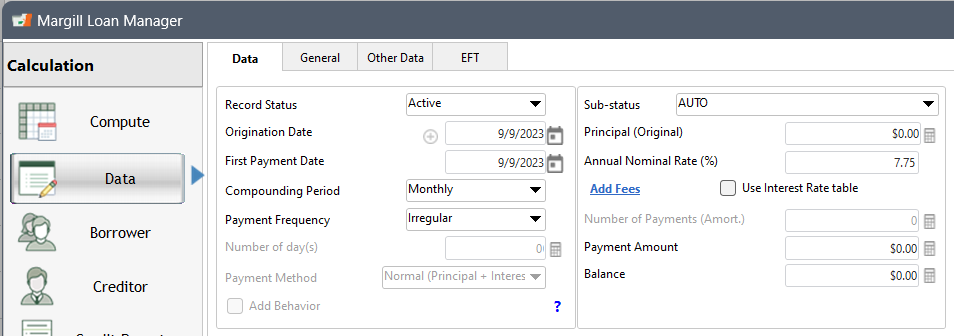

2) Client and Loan (Case) creation

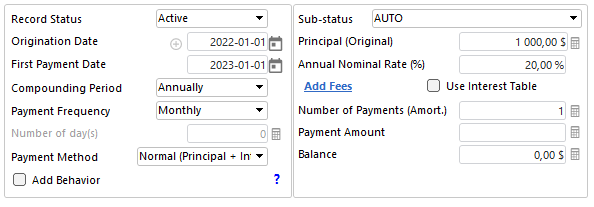

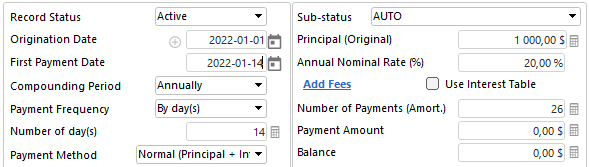

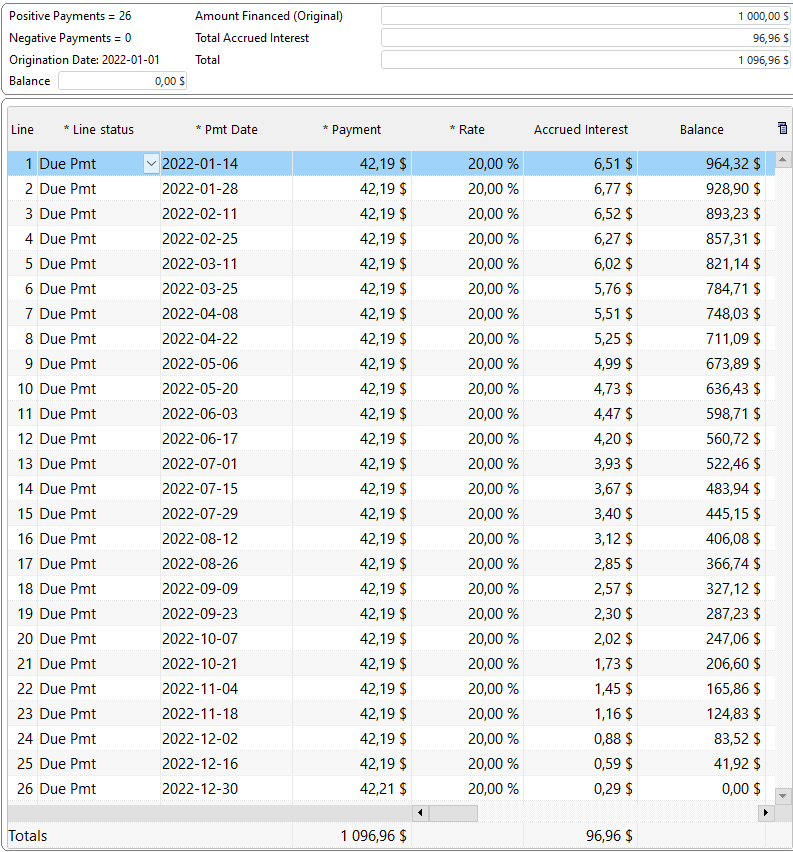

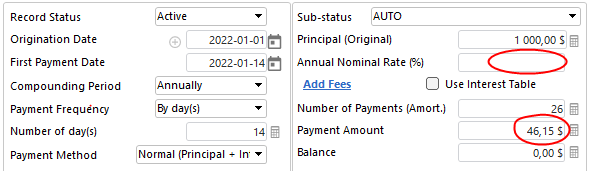

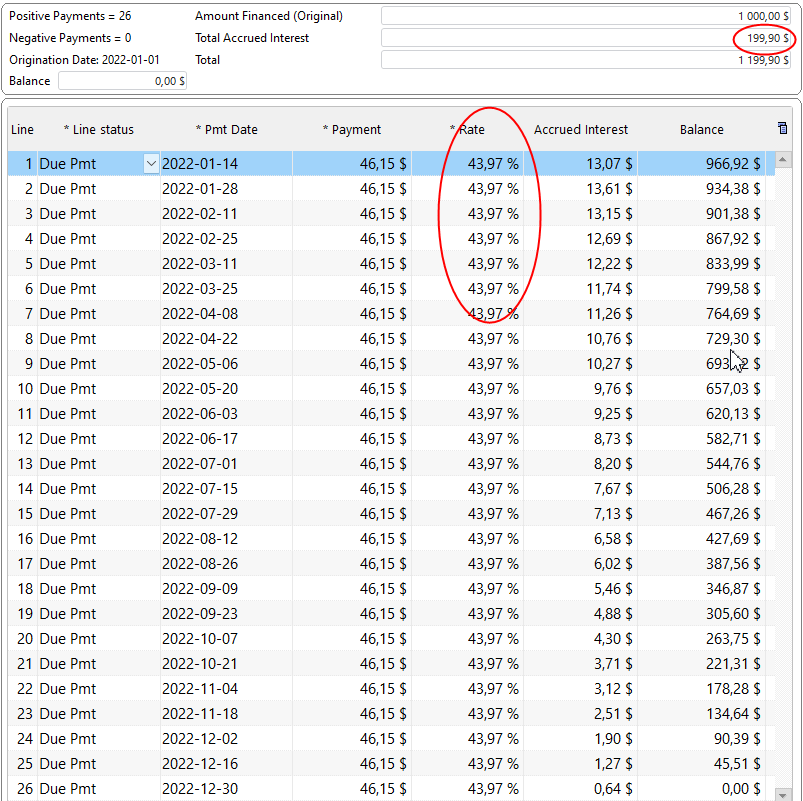

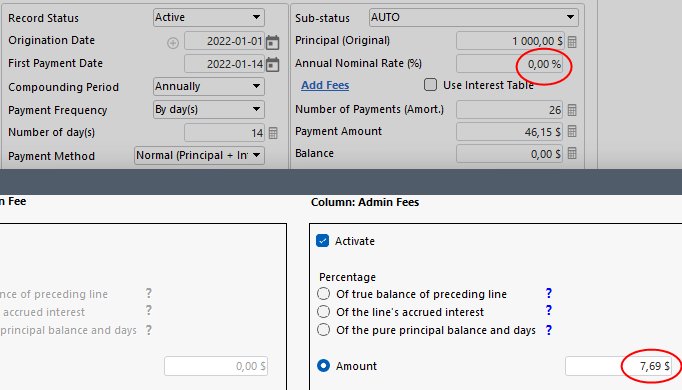

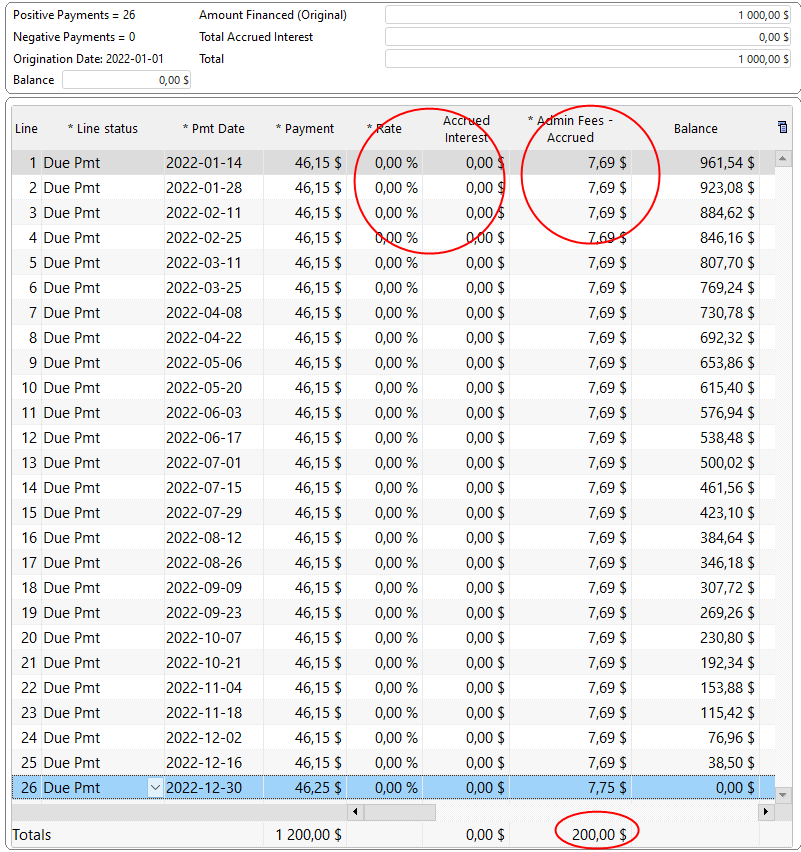

A Loan / Line of credit or Case in legal jargon, can be created in Margill by entering these data (minimum information needed):

- Start (Origination) Date and First Payment Date (in litigation loans, these are usually the same date)

- Interest rate (or Interest Rate table)(could also be a default rate so could not be needed)

- Unique Loan ID (from other system)(required only for auto import)

Any other data can be entered as required (court case, client names, email, address, mobile, case type, active or draft, and other special data…).

This information is entered in the Data window either:

- manually;

- in bulk manually via a simple Excel file;

- in bulk automatically via an Excel or JSON file (what we call “hot folders” where, when a file is deposited in a specific folder, Margill will automatically grab the file and import the data).

Since law firms can use a wide variety of systems – practice management solutions and accounting systems, a data conversion app may be required to convert third party data to a format accepted by Margill Loan Manager (JSON and Excel files). This can be developed by our programming team.

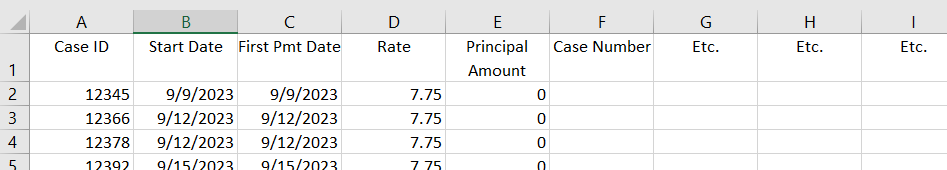

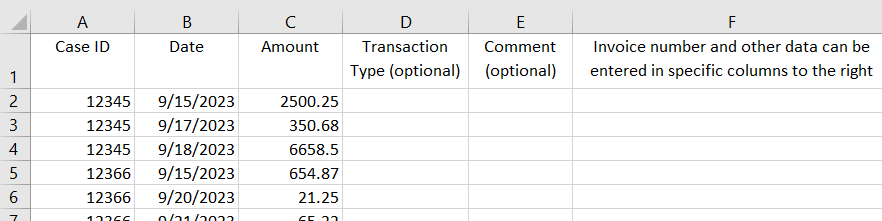

Typical Excel sheet for Case creation in Margill:

Principal amount is required but is usually 0.00 as case Costs and Fees will be added as line items (see 2) below)

The Case(s) will then appear in the Main MLM window with nothing really exciting so far – only the basic data. It gets fun when transactions are added!

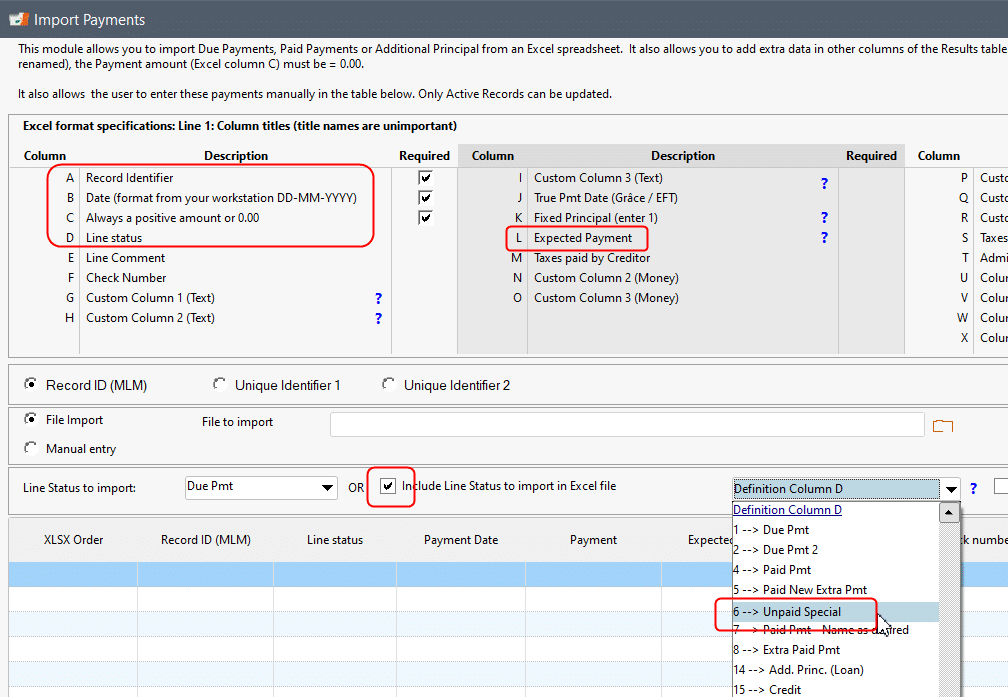

3) Cost and Fees (transaction) import

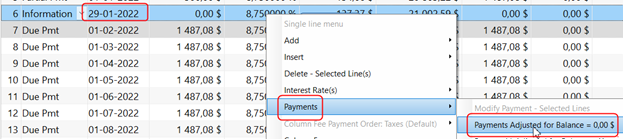

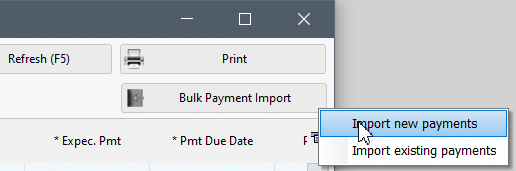

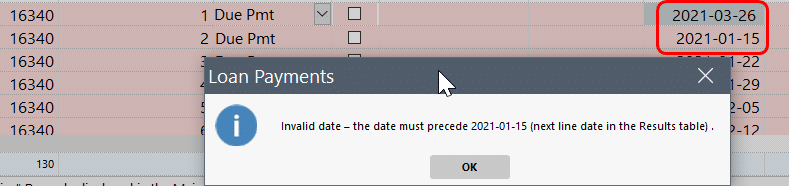

Once a Case if created, Costs and Fees (and payments) can be imported at any date after the Start (Origination) Date. They can be entered:

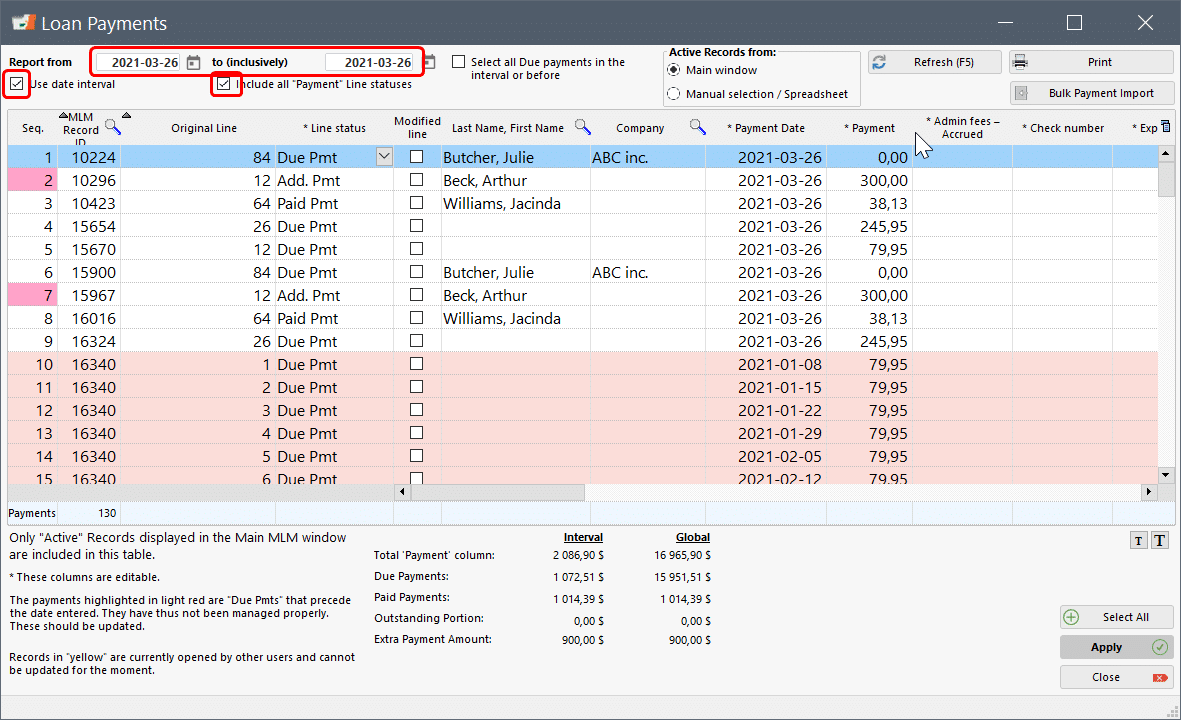

- manually Case by Case (for very low activity volume)

- manually for multiple Cases at once

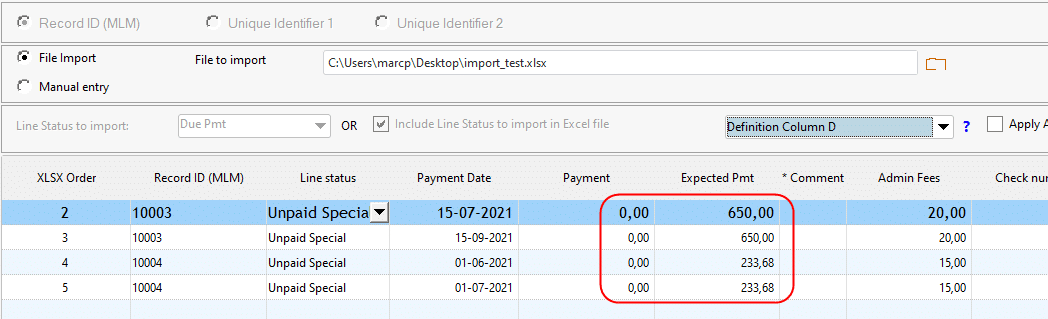

- in bulk with an Excel sheet manually

- in bulk with an Excel sheet automatically

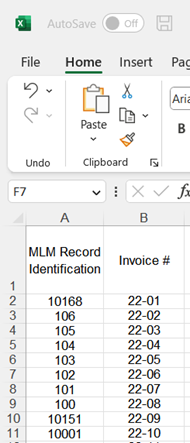

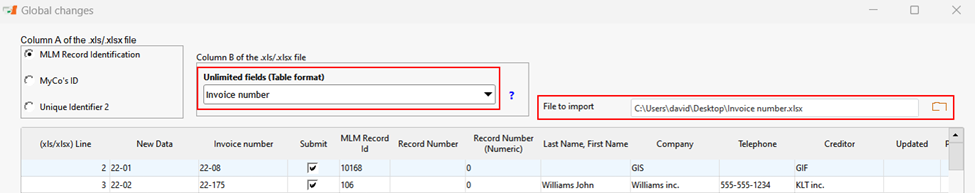

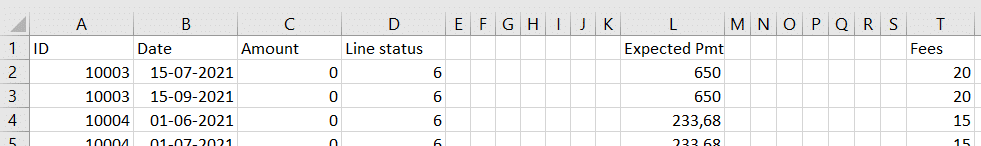

For the bulk imports, the Excel sheet must follow this precise mapping:

For any auto imports, the ISO date format MUST be used: YYYYMMDD

3a) Cost and Fees (transaction) import from other systems

If your law firm must import data (transactions) from an accounting software (QuickBooks or other) or a practice management system and this system does not support the production of an Excel sheet as above, a special conversion application can be created by the Margill programming team that converts the file your system produces, to the Margill format which can then be imported manually or automatically. Such an app saves time and avoids errors.

4) Special situations

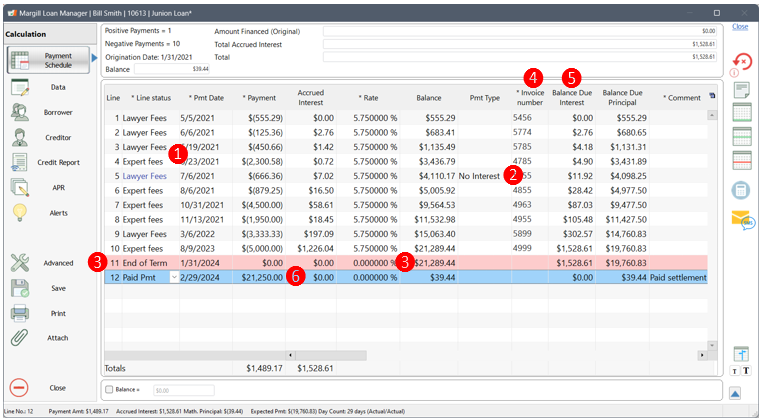

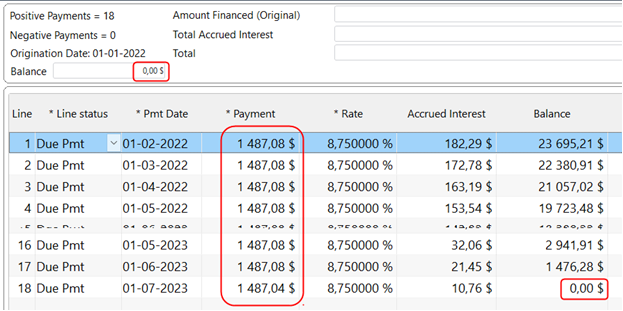

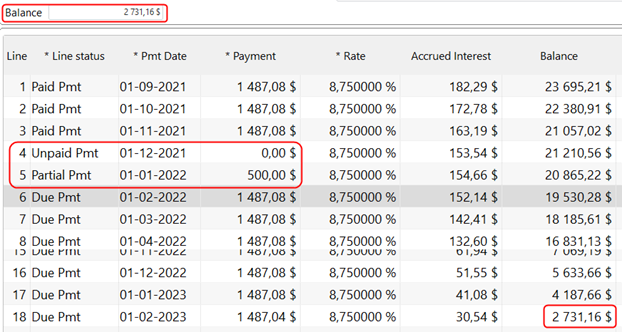

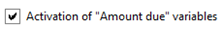

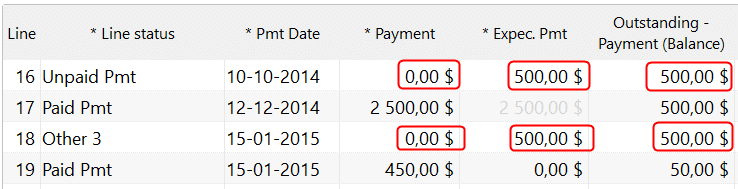

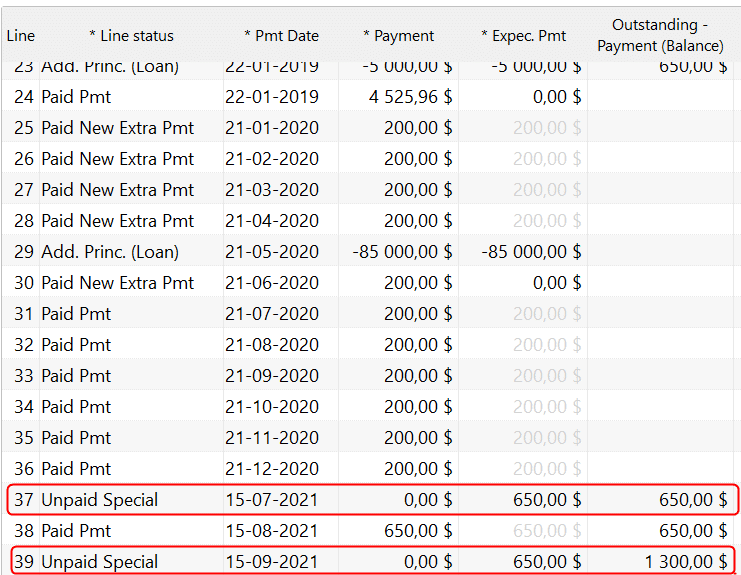

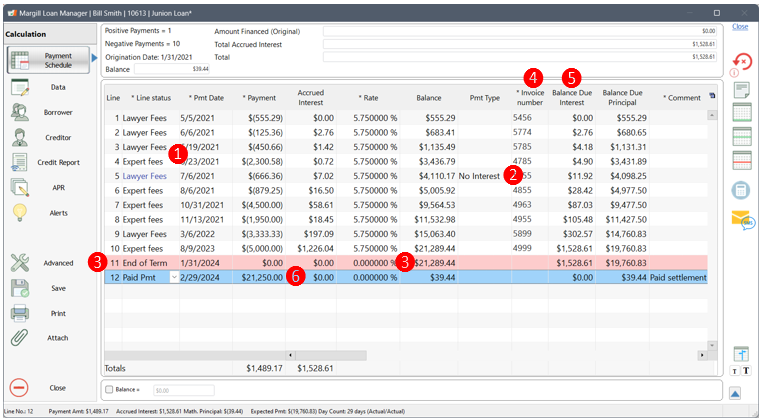

A host of special situations can be handled by MLM (the numbers correspond to the red numbers in the image below):

- (1) One or many, up to nine (9) Fee types (Lawyer Fees and Expert Fees – could be named as you wish – Medical Expense, Expert Expense, Medical Expense no interest, etc.).

- (2) Line 5 shows the $666.36 Lawyer Fees that do not bear interest (blue Line status and Pmt Type column).

- (3) As of 1/29/2023, interest is no longer charged on all amounts since maximum 3 year Term (optional of course). Line color was changed to red to highlight the End of Term.

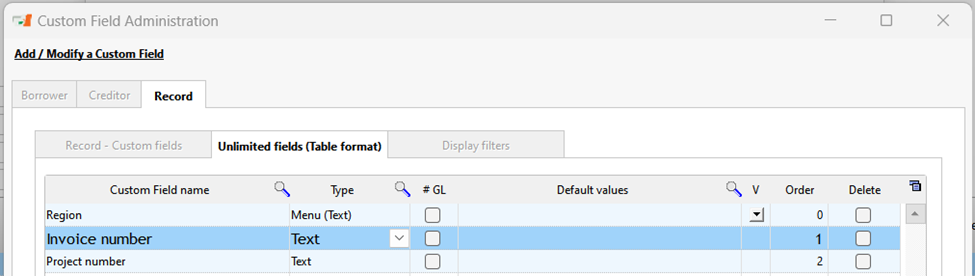

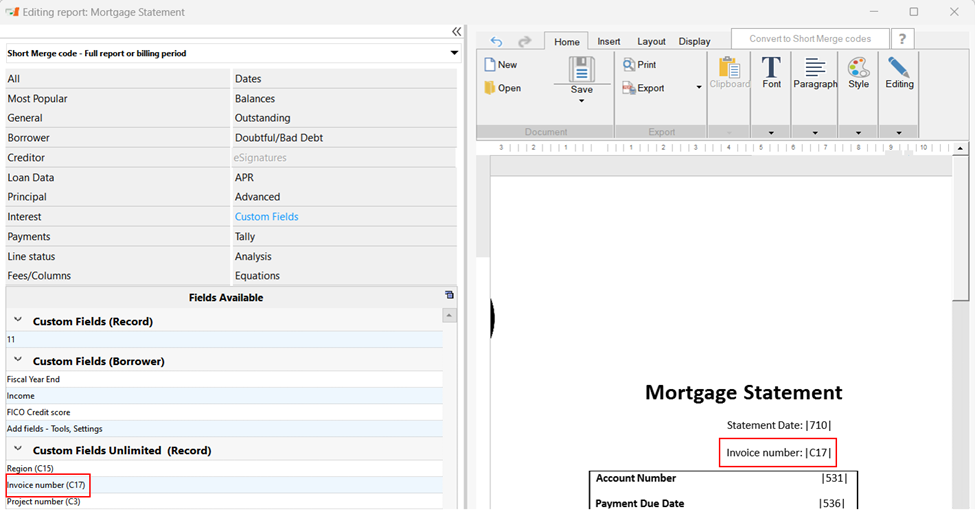

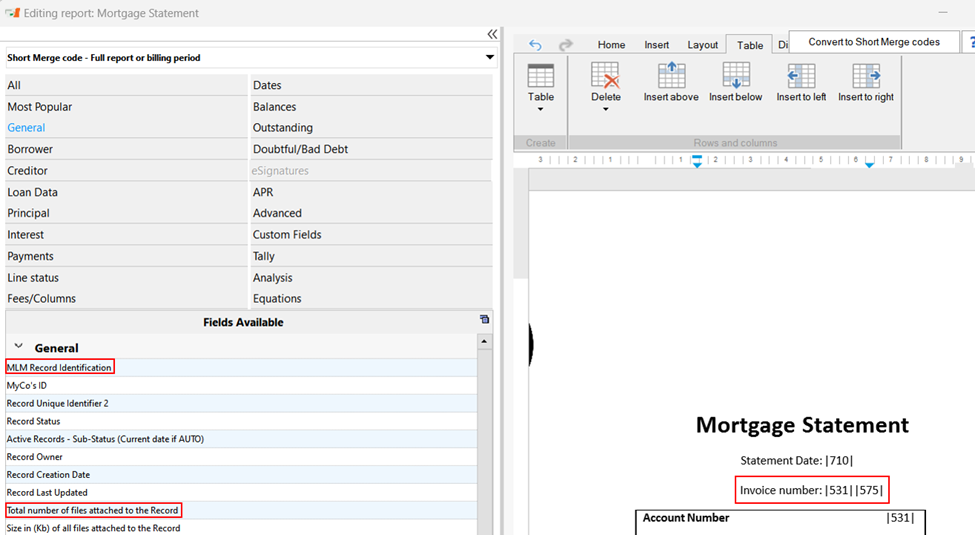

- (4) An Invoice number was added for each invoice.

- (5) A Comment may be added on any line.

- (6) Final settlement of $21,250. All interest got paid first but we could have paid the $19,760.83 in Principal (the Fees) and there would have been an interest balance of $39.44 instead of Principal balance for this amount – you have the options with the Line statuses.

- Interest can start 30 days after the invoice date so the Pmt Date entered would be the invoice date + 30 days. The actual invoice date could be in another column (not shown below).

- The Case can also be lost in which case, instead of a Payment at the very end, there would be a Line status that could be called “Loss” or “Bad debt” to bring the balance to 0.00 and to isolate the fees and interest as unrecoverable for your accounting (not shown below).

- Many other options are available…

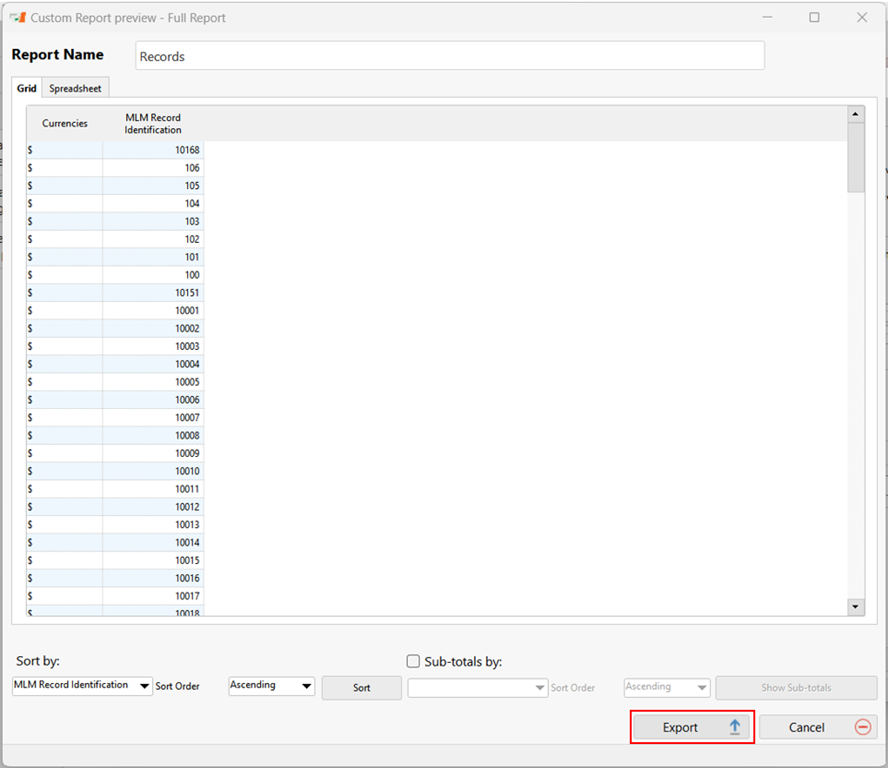

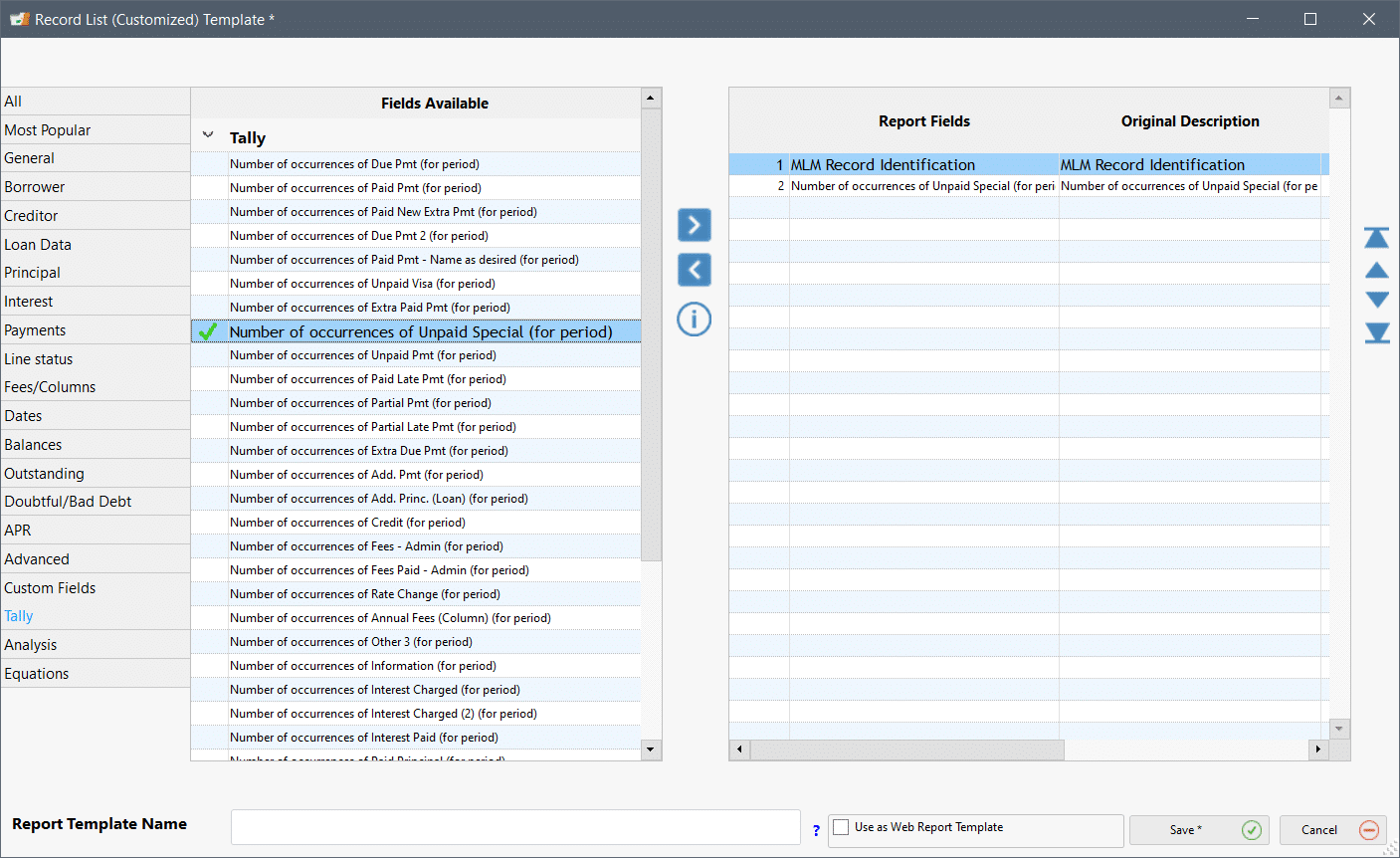

5) Reporting

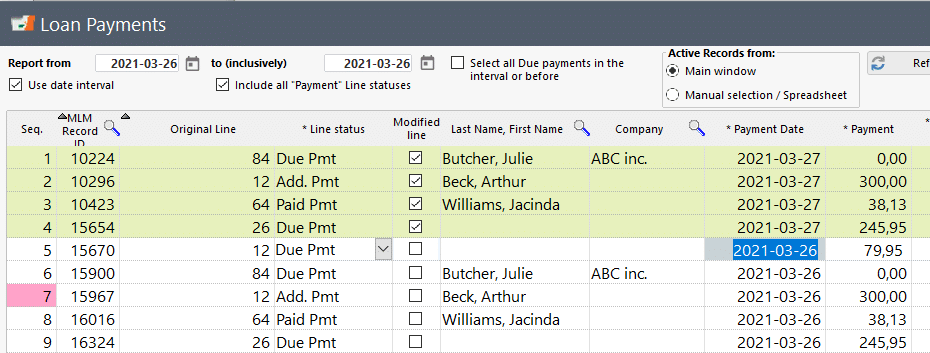

You can create your own reports for any time period using over 1000 fields. Typical reports would be daily, weekly, monthly, quarterly, yearly…:

- Disbursed Costs and Fees

- Interest generated (accrued)

- Interest actually paid or collected (as opposed to simply accrued)

- Fees by Case type

- Cost and Fees paid back

- Fees lost (Case was lost)

- Balances

- and many more, such as socioeconomic information for decision makers (statistical data).