How to extend a loan once the loan has reached a maturity? Term is to be extended by 48 months.

Question:

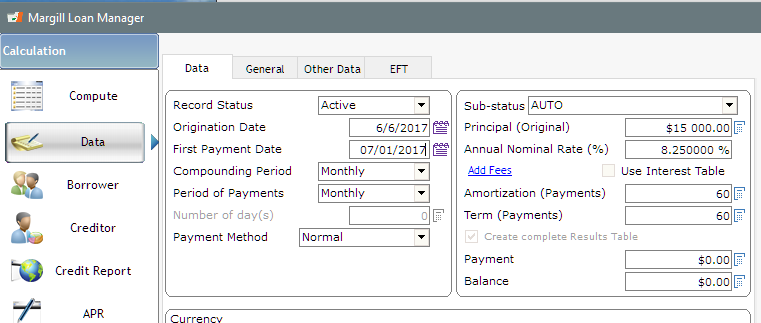

How to extend a loan once the loan has reached a maturity? Term is to be extended by 48 months.

Answer:

As you may know, Margill Loan Manager is probably the most visual software on the market so this kind of change takes a second.

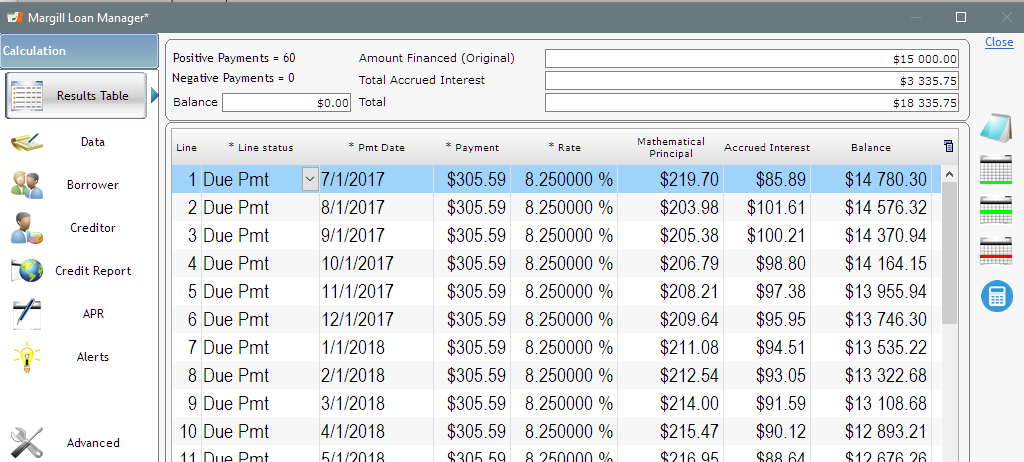

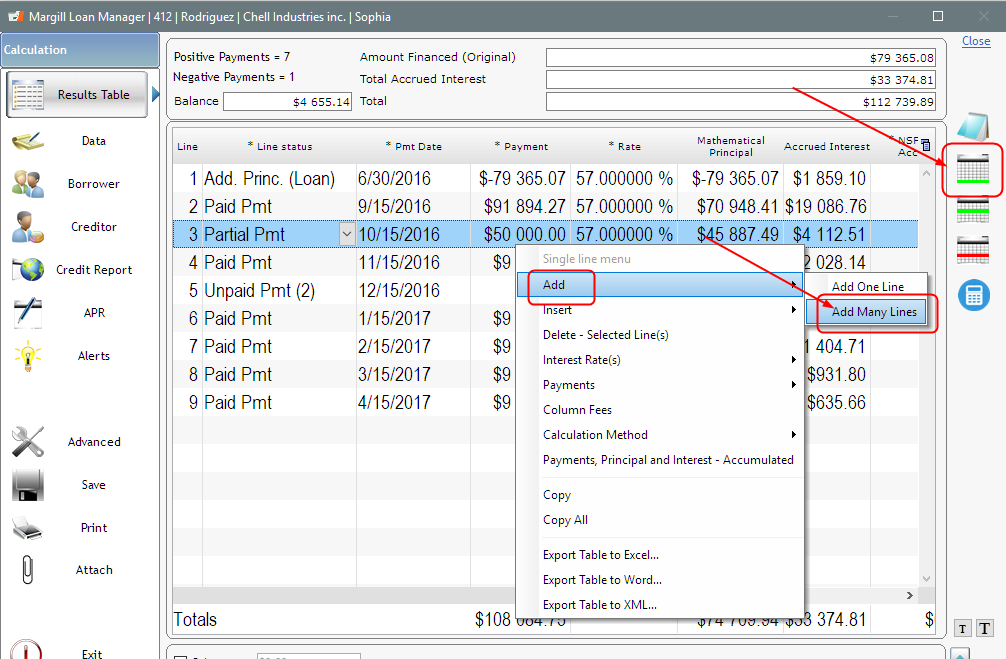

In the payment schedule, simply click on the  icon to the right of the window or right click with the mouse > Add > Add Many Lines.

icon to the right of the window or right click with the mouse > Add > Add Many Lines.

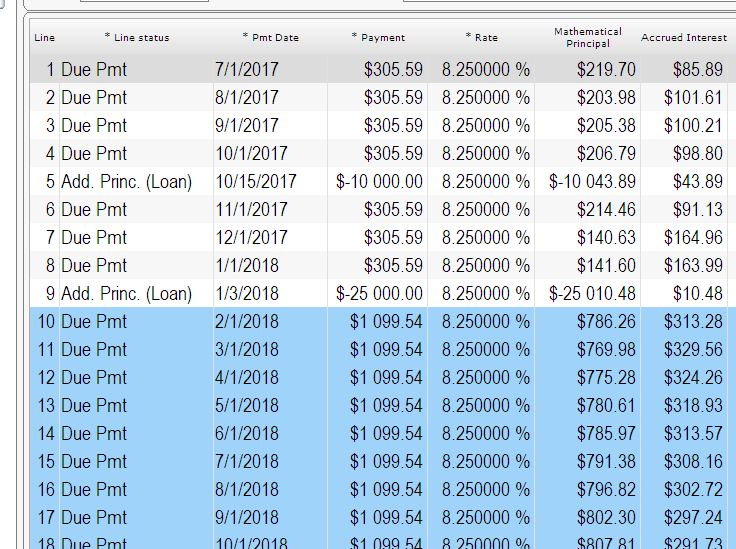

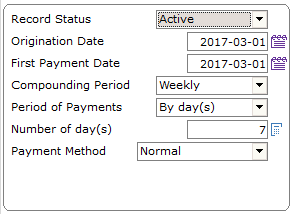

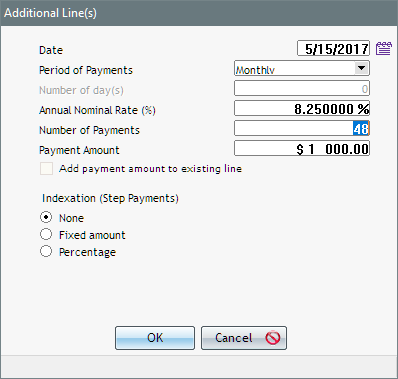

Then specify 48 Payments and the Payment Amount. Add other specifications such as the payment frequency (monthly or other) and when the next payment (after the initial loan end date) is to be paid.

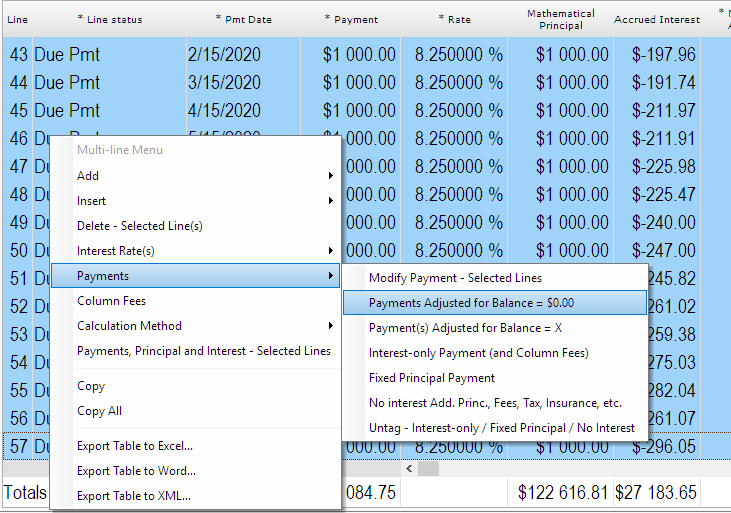

You can also go one step more by selecting your 48 lines, right click and have the payment recomputed to give 0.00 as the final balance or another residual amount.

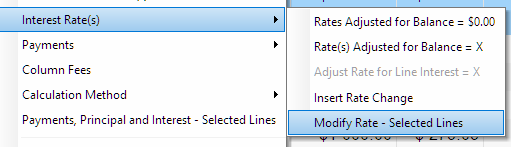

Even the interest rate could be changed for the next 48 payments (as always with the right mouse click):