September 4, 2024

The transition from Perceptech to VoPay is done in a few minutes in Margill. Simply follow the instructions below and follow the short “Transition Wizard” in Margill.

1) Before the transition, it is important to know that the following fields are mandatory for the Borrower:

- Name, First name (or Company), Address, City, Province, Country, Postal Code

The formats below are also mandatory, but some exceptions have been programmed in Margill, see paragraph ** below.

- Province: Must be a valid two-letter provincial or territorial code (alpha code)

- Provinces and territories : AB, BC, MB, NB, NL, NT, NS, NU, ON, PE, QC, SK, YT

- Country: Must be a valid two-letter country code as defined by ISO 3166-1 alpha-2 – Canada = CA

- City: These special characters are not allowed : Comma, underline and parentheses

- Postal Code: Must be in standard A9A 9A9 or A9A9A9 format

** For Province and Country, MLM performs the necessary transformations before transmitting payments to VoPay when Provinces and Countries are entered in various ways. For example, if in the Borrower’s file it is written Ontario, Ont, Ont., etc., the Province will automatically be converted to ON in the VoPay file. Therefore, you would not have to modify your data in the database, however it is strongly recommended that you do.

To avoid last minute problems, it is STRONGLY suggested to check all this data relating to the Borrower BEFORE making the transition. You should produce a report with these fields in all Records, check them and you then can re-import them with the corrections via an Excel sheet and Global Changes. See our article to carry out this operation: https://www.margill.com/en/margill-loan-manager-update-of-borrowers-data-with-the-global-changes-and-an-excel-sheet/. Note that accents are allowed.

2) Download and install the latest version of Margill Loan Manager (version 5.6 from September 2024 – many minor but important corrections have been made in previous version 5.6) on www.margill.com/get

- If you use the SAAS version (cloud hosted), the update will be carried out for you starting in July. Please contact us ([email protected]) to advise us of your desired transition date to VoPay.

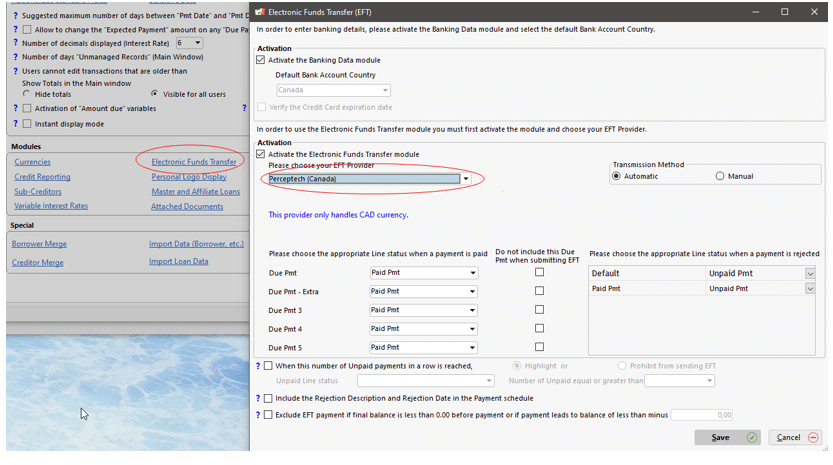

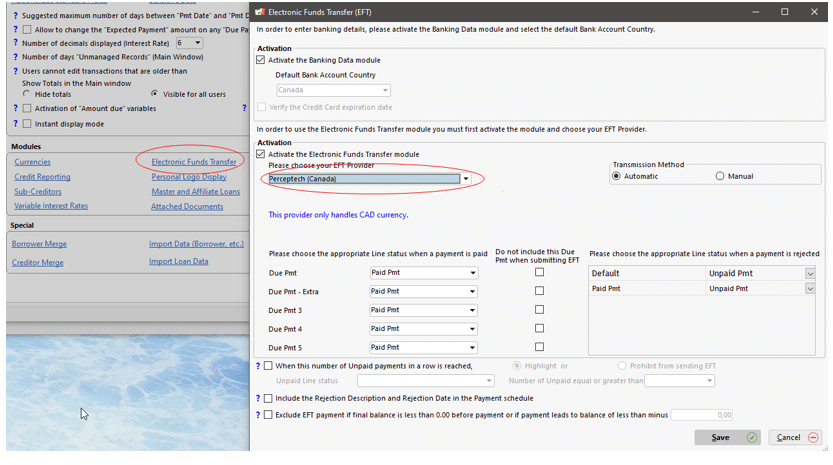

3) A Margill Admin must go to Tools > Settings > Modules > Electronic Funds Transfer.

The current provider is “Perceptech (Canada)”.

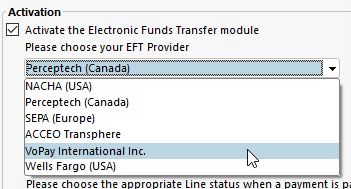

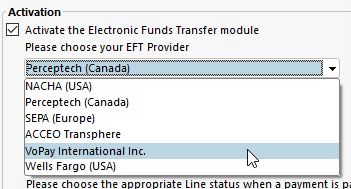

In the scroll menu, change the provider to “VoPay International Inc.”

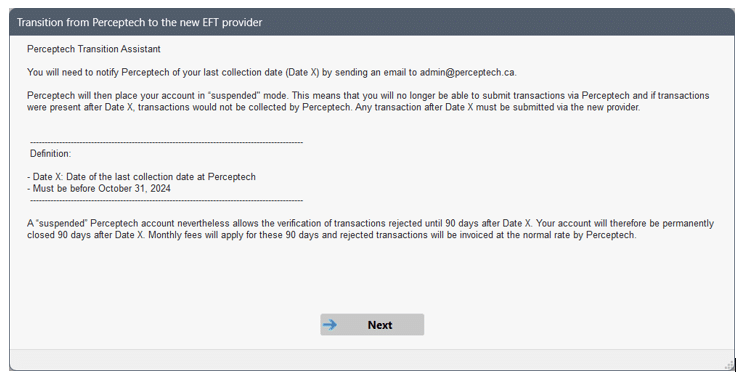

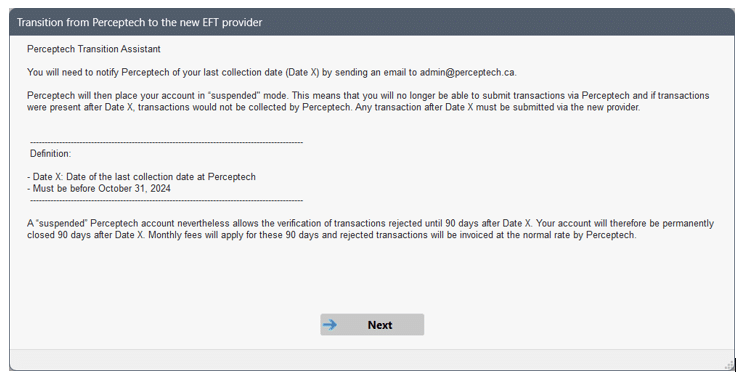

You will get this message:

Follow the instructions. Enter the date of the last collection with Perceptech when prompted in Margill and send this date to Perceptech at [email protected]. The message is simply:

- Our company XYZ will make its last debit with Perceptech on September XX, 2024.

If you deposit to many bank accounts, please advise them.

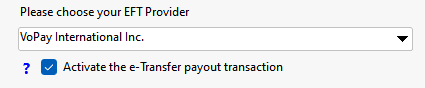

NOTE: VoPay also offers a service to actually credit your Borrower bank accounts. You can activate this service by checking the box:

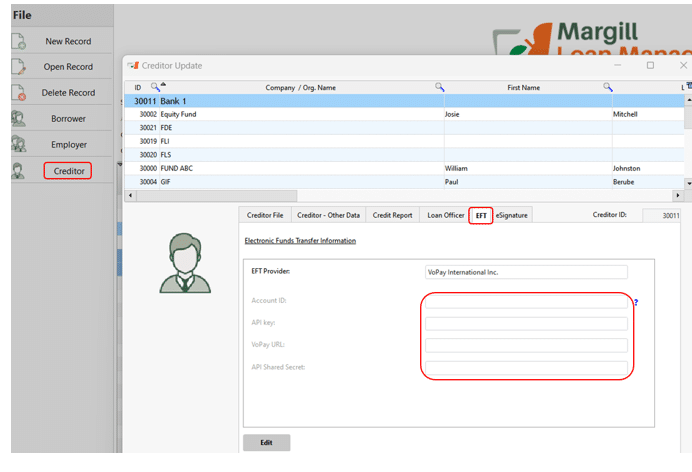

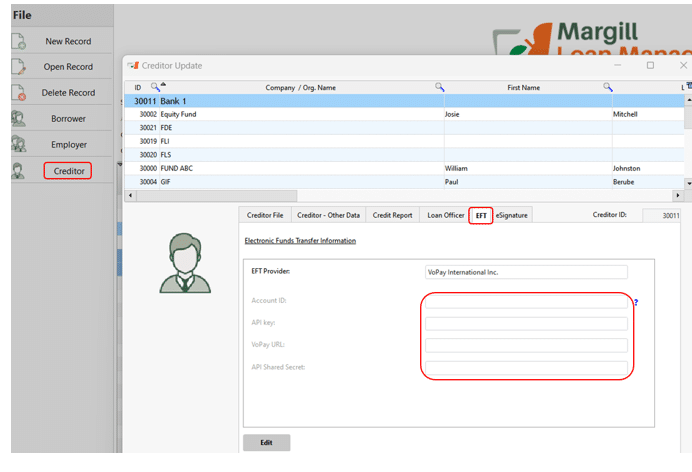

3) You will then need, for each of the Creditors with EFT accounts, to update the data in the EFT tab. This data was provided to you by VoPay.

4) You can submit you EFTs exactly the same way you used to do with Perceptech.

Note that data pre-validation is carried out by VoPay allowing you to correct certain errors before the collection date. See the Margill Loan Manager User Manual on page 231 (https://www.margill.com/margill-loan-manager/user/MLM-User-Guide.pdf) and see page 254 for explanations of pre-validation.

Happy transition!

Margill Team

[email protected] / [email protected] / [email protected]