Loan Servicing and InterestCalculation Software

Margill

Loan Manager

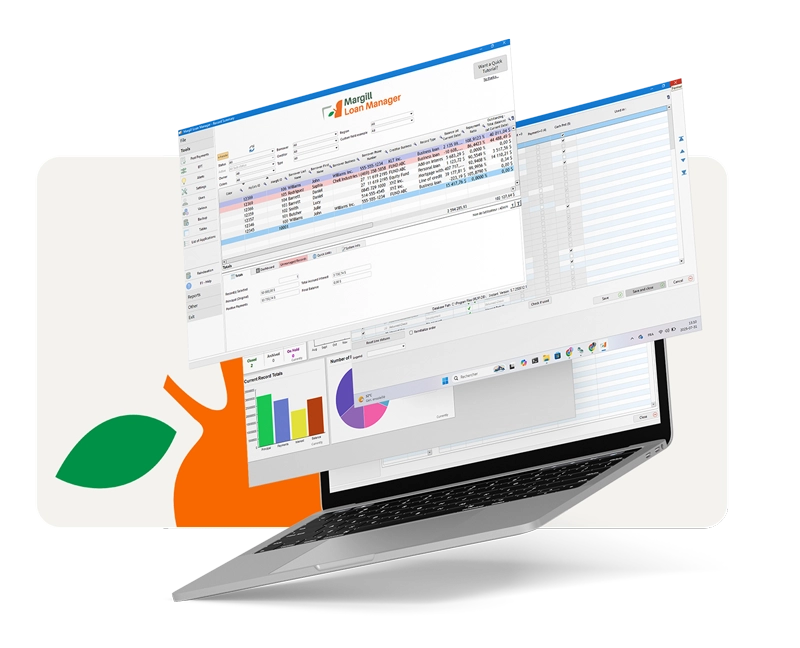

Transform hours of loan Servicing into minutes.

Save time – avoid errors – generate real-time reports.

Margill

Interest Calculator

The global standard for simple and complex interest calculations, amortization, and more.

Margill

Law Interest Calculator

The most trusted interest calculation solution for legal professionals.

Why Margill

Proven Reputation

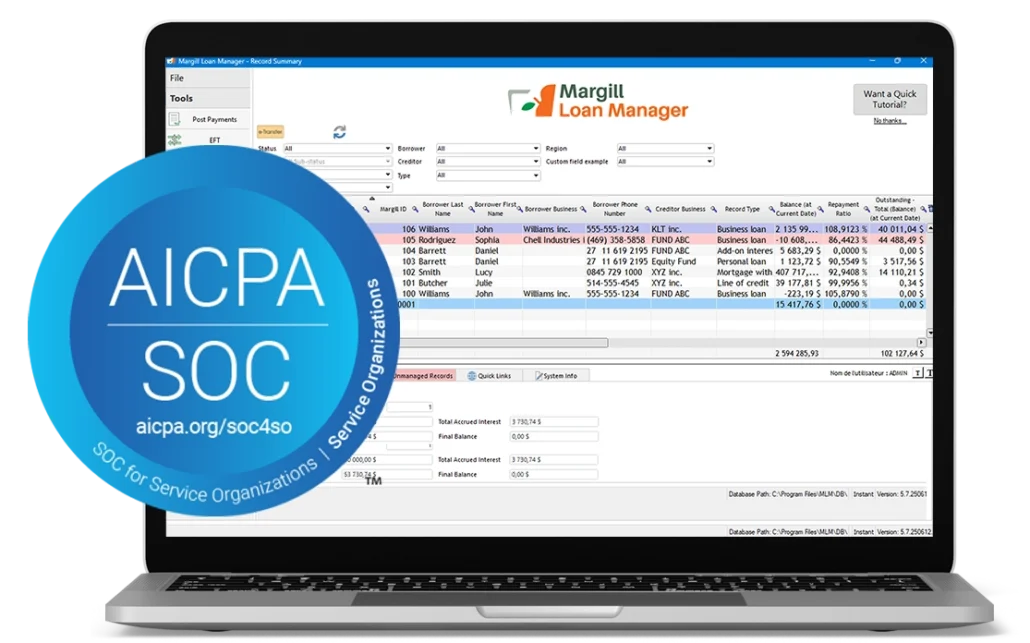

Margill products are used in over 50 countries by thousands of professionals and organizations, including the U.S. Securities and Exchange Commission (SEC), Toyota USA, Department of Justice Canada, SBA Bank, Manulife Financial, Norton Rose to name a few…. Margill Loan Manager Cloud is now SOC2 compliant.

Solid Mathematics

Margill products are the choice of public – and private-sector companies, regulatory agencies, banks, law firms, courts, accountants and governments because of their mathematical superiority – handling complex payment scenarios, irregular schedules and special refund methods.

Flexible Customization

With unlimited custom fields, menus, dashboards, payment types and reports, Margill Loan Manager allows you to configure the software to match your organization’s reality. Talk to one of our specialists to learn more.

Unparalleled support

The Margill team includes experienced senior and junior programmers, lawyers and external consultants. When it comes to interest calculation and loan management, Margill is the expert.

-

Accelerating Automation in Loan Management

Read more: Accelerating Automation in Loan Management -

Enabling Windows Task Scheduler to Generate Automated Reports

Read more: Enabling Windows Task Scheduler to Generate Automated Reports -

Enabling and Using Automated Reports in Margill Loan Manager

Read more: Enabling and Using Automated Reports in Margill Loan Manager -

Margill Loan Manager 6.0 is out — and the New Website is finally live!

Read more: Margill Loan Manager 6.0 is out — and the New Website is finally live! -

Webinar – What’s new in version 5.6

Read more: Webinar – What’s new in version 5.6 -

Jurismedia / Margill Loan Manager Achieves SOC 2 Type 2 certification

Read more: Jurismedia / Margill Loan Manager Achieves SOC 2 Type 2 certification

Margill &

Industry News

Stay informed about Margill’s latest product innovations, industry trends, and financial software updates.

Testimonials

Discover testimonials from our users and their experience with our… beyond expectations… products and services

-

We started a small micro loan company in 2016, with little to no experience and loan management. Marc and the team were exceptional in steering us in the right directions, but more importantly, the software performed like a champion. The ease of loan and loan document management, the seamless transfer of data between Margill and Quickbooks, and the EFT integration make this program indispensable. I HIGHLY recommend this to anyone thinking of starting a business in the loan industry.

Jonathan Jacobson, 198Loans.com

-

We are a small business with a few hundred ongoing loans. Although some upfront learning is required Margill is ultimately easy to use and powerful. The technical service provided by Margill is some of the best we have found among software companies.

James Hutchison, Hutchison Oss-Cech Marlatt

-

Once you have set up everything accordingly. Margill loan manager is really easy to follow. It helps us creates a loan in few minutes. It is very useful in reviewing our clients information and their payments history. Updates were recorded efficiently for future references.

Kaye C, Adwell Financial Services Inc.

-

We have been using Loan Manager for nearly two years. We are very satisfied. We find posting payments, creating new accounts, preparing end of month reports and sending monthly statements to be easy and always accurate.

Donald Ross, Moose International, Inc.

-

The Prescott-Russell Community Development Corporation (PRCDC) has been using Margill Loan Manager software since 2013.

With Margill, we can create reports for all our needs and the needs of our clients, whether for a general or specific report, with the huge field base, equation management, standard or tailored reports. The calculation tables (depreciation) are clear and very precise.

Even tasks such as correspondence, databases, global calculations, individual calculations, and billing are done with ease. It is a user-friendly, professional software, and a charm.

We would also like to note that the support of the Margill team was and is still phenomenal and on behalf of the SDCPR, we thank you.Pauline Chevrier, Prescott-Russell Community Development Corporation

Some of our clients

Loan Servicing Software for accurate interest calculations and portfolio management

A private lender once discovered that a rounding error in a spreadsheet had inflated interest on hundreds of loans for more than a year. The mistake stayed invisible until an audit forced a full reconstruction of every balance. This led to months of work, legal exposure, and client disputes—the real cost of managing complex loans with fragile tools.

Dedicated loan servicing software replaces manual formulas with a controlled, consistent calculation engine consistent across every loan, every payment, and every reporting period. It makes interest computation a reproducible, auditable process, eliminating hidden operational risk.

A loan servicing solution has become a core system for financial institutions, private lenders, trustees, corporate finance teams, and law firms that need to defend their numbers under audit, in court, or before investors.

How modern loan servicing improves operational accuracy

Loan servicing covers daily interest accrual, payment allocation, fee application, and balance updates throughout the life of a loan. Manual processes rely on user-dependent formulas that silently drift over time. A servicing platform replaces those formulas with a centralized interest accrual engine that applies a single source of truth. This centralized logic relies on consistent day-count conventions and can also reference official interest rate tables to ensure uniform calculations across the entire portfolio.

The system supports:

- Simple and compound interest

- Daily interest accrual

- Fixed and variable interest rates

- Proration for partial periods

- Automatic leap-year handling

- Day-count conventions: Actual/Actual, Actual/365, 30/360 and Actual/360

When a payment arrives, the engine allocates it according to predefined rules without altering historical balances. The result is calculation continuity that survives restructurings, audits, and disputes.

Key capabilities of a scalable loan management system

A Loan management system defines how loans behave from origination to closure. It standardizes contractual logic across portfolios instead of rebuilding calculations loan by loan.

Core capabilities include:

- Configurable amortization schedules

- Rate changes over time

- Multi-currency handling

- Structured allocation rules known as the payment waterfall. This waterfall determines how incoming payments are automatically distributed between interest, principal, fees, and penalties based on contractual priority.

Every adjustment is logged with full version history. This guarantees traceability and prevents “silent recalculations” that are impossible to audit retrospectively. For centralized management of this type, platforms like Margill Loan Manager make it possible to replace fragmented systems.

How structured loan management supports financial control

Effective loan management is not just transaction processing. It is continuous loan portfolio management with real-time financial visibility.

Finance teams monitor:

- Outstanding balances

- Accrued and paid interest

- Paid principal

- Delinquency trends

- Projected cash flows from a single system.

Risk exposure becomes observable at portfolio scale instead of hidden inside individual spreadsheets. Deviations appear immediately, not after month-end reconciliation.

For legal teams, this structure provides defensible historical calculations during litigation, enforcement, and restructuring. Every number can be reproduced with the same logic that generated it originally.

What to expect from a secure loan servicing platform

A modern loan servicing platform connects calculation logic with accounting and reporting systems through APIs. It removes double data entry, synchronizes balances automatically, and ensures that financial statements always match servicing records.

Key technical expectations include:

- Encrypted storage

- Role-based permissions

- Log of all activities

- Automated reporting

- Extended logic delivered through custom programming services

Scalability allows the same platform to manage dozens or tens of thousands of loans without structural change.

FAQ About Loan Servicing and Interest Calculation Software

Yes. Modern platforms allow extensive customization of interest logic, payment waterfalls, accrual schedules, custom fields and reporting formats. Organizations can adapt the system to jurisdiction-specific regulations, internal controls, and product structures. For example, a lender may configure different waterfall priorities for senior and subordinated debt.

Custom rule engines ensure the software adapts to your operations, not the reverse.

Yes. Modern loan servicing platforms are designed to replace fragmented legacy systems that rely on aging code or disconnected modules. Migration typically involves importing historical loan data into the new calculation engine. Once operational, the new system centralizes servicing, reporting, and integration with accounting systems.

If legacy systems limit visibility or audit reliability, migrating to a modern platform can rapidly reduce operational risk.

Finance teams track loan portfolio performance through centralized dashboards inside the servicing platform. These dashboards consolidate accrued and paid interest, outstanding balances, delinquency status, and projected cash flows across all loans. Instead of compiling data across multiple spreadsheets, teams view portfolio health from a single system. For example, risk exposure across variable-rate loans can be analyzed instantly without manual aggregation. This continuous visibility allows earlier intervention on deteriorating assets and supports more accurate forecasting and liquidity planning.

Loan servicing software calculates interest using configurable logic defined at loan setup. It supports simple interest, where interest is calculated only on principal, and compound interest, where accrued interest itself generates interest. The system applies this logic through its centralized interest accrual engine using the selected accrual frequency and day-count convention. For example, in a compound structure with daily accrual, interest is recalculated every day on the updated balance. This automation prevents inconsistencies that often arise when users alternate between formulas manually in spreadsheets or validate logic outside the system using tools such as the Margill Interest Calculator.

Loan servicing software applies prepayments and partial payments through its automated allocation logic. When a borrower pays more than scheduled or only part of the amount due, the system recalculates interest, principal, and remaining balances automatically. The impact on future interest accrual is applied immediately based on contractual rules. For example, a prepayment may reduce principal and lower future interest exposure without affecting past accrued interest. This avoids the recalculation errors that commonly occur when adjustments are handled manually.

Auditors require complete transparency into how financial figures are produced. Loan servicing software provides full audit trails for every calculation and modification. Each rate change, payment, restructuring, and recalculation is logged with timestamp and user identity. For regulated institutions, this traceability is essential for examinations, compliance reporting in audit or dispute contexts. Instead of reconstructing calculations from fragmented spreadsheets, auditors access a consistent, system-generated record of financial activity.

Loan servicing software pricing usually varies based on portfolio size, feature scope, and integration needs. Two options are generally available: monthly subscription to a cloud-based software as a service SAAS) or a license with local installation on a corporate or shared drive. Pricing often scales with the number of loans, users, and required integrations.

Transparent pricing aligned with portfolio size helps organizations evaluate return on investment before deployment.

Loan servicing software is a dedicated system that automates interest calculations, payment allocation, balance tracking, and reporting throughout the life of a loan. Unlike spreadsheets, where formulas vary by file and user, the software applies a single centralized calculation engine across all loans. For example, when a payment is received, unless otherwise instructed, the system automatically applies it according to predefined rules: fees first, then interest, then principal. With spreadsheets, those same calculations often depend on manual updates that introduce silent errors over time. Dedicated software ensures traceability, standardized logic, and reproducibility under audit or legal review.

Payment waterfall logic defines the contractual priority used to allocate each incoming payment between interest, principal, penalties, and fees. For example, a waterfall may require fees to be paid first, then interest, then principal. Loan servicing software enforces this allocation automatically. If a borrower makes a partial payment, the system applies it precisely according to the waterfall without altering historical balances. Without automated waterfall logic, manual allocation often introduces inconsistencies that later compromise audit accuracy and legal defensibility. The user will retain the right to modify this refund sequence in special circumstances.

Day-count conventions define how the system converts calendar time into interest calculations. Under 30/360, every month is assumed to have 30 days and the year 360 days, commonly used in corporate and municipal lending. Under Actual/365, interest is calculated using the actual number of days divided by 365. These conventions materially affect interest amounts over time. The user has the option to apply the proper convention according to their needs. Other day-count conventions available include Actual/Actual and Actual/360.

Spreadsheets expose organizations to calculation drift, version conflicts, broken formulas, and undocumented changes. Over time, different users may alter logic without realizing long-term consequences. For example, a small rate change applied incorrectly across a portfolio can compound into material financial misstatements. Spreadsheets also provide limited auditability. Reconstructing how a balance was calculated months earlier often becomes impossible. This creates legal vulnerability during audits, disputes, or compliance reviews. Dedicated loan servicing software eliminates these hidden risks by enforcing controlled calculation logic and preserving full historical traceability.

Loan servicing software manages a wide range of loan types, including term loans, revolving credit, syndicated loans, construction financing, mezzanine debt, and private lending structures. It supports fixed and variable rates, multi-currency portfolios, and customized repayment schedules. For example, a private equity firm may manage bridge loans, while a trustee manages mortgage-backed facilities. The configurable nature of the calculation engine allows the same platform to support diverse financial instruments under consistent governance.

Law firms depend on interest calculation software to produce defensible interest calculations that can withstand expert scrutiny. In disputes involving default interest, restructuring, or enforcement, courts require precise, reproducible calculations. A calculation platform preserves historical accrual logic, day-count conventions, and payment application rules. Instead of rebuilding months or years of calculations manually, legal teams can demonstrate exactly how every balance was generated using tools such as the Margill Law Interest Calculator.

Questions ?

Ask us !

Questions about Margill solutions? Our team is here to help! Reach out with any inquiries, and we’ll provide the answers and guidance you need.

+1 877 683-1815 / +1 450 621-8283